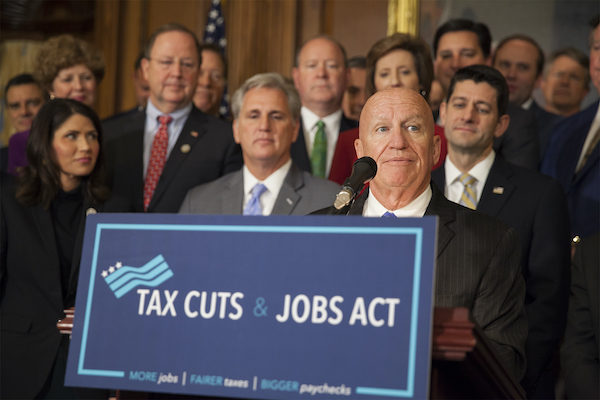

Tax Reform 2.0 Passes House

Friday, the U.S. House of Representatives passed a package of three bills, H.R. 6760, the Protecting Family and Small Business Tax Cuts Act of 2018, H.R. 6757, the Family Savings Act of 2018, and H.R. 6756, the American Innovation Act of 2018, to build upon the accomplishments of the Tax Cuts & Jobs Act. I voted in support of this package to lock in the tax cuts for families and job creators of all sizes:

Friday, the U.S. House of Representatives passed a package of three bills, H.R. 6760, the Protecting Family and Small Business Tax Cuts Act of 2018, H.R. 6757, the Family Savings Act of 2018, and H.R. 6756, the American Innovation Act of 2018, to build upon the accomplishments of the Tax Cuts & Jobs Act. I voted in support of this package to lock in the tax cuts for families and job creators of all sizes:

The Tax Cuts and Jobs Act is working for the American people. Our booming economy, historically low unemployment rate, and soaring consumer confidence all add up to a stronger nation. But we're not stopping there. The package passed today, known as Tax Reform 2.0, builds upon these accomplishments and locks in the tax-cuts for hardworking Americans to ensure more of your money stays where it belongs, in your pocket. These bills also advance our efforts to support job creators of all sizes, from small businesses to manufacturers shipping their products worldwide who suffered under our archaic tax code, we're making sure America is, and remains, open for business.

H.R. 6760 - Protecting Family and Small Business Tax Cuts Act of 2018

- Makes permanent the comprehensive reforms to the Internal Revenue Code of 1986 to provide tax relief and simplification to American families, individuals, and small businesses.

H. R. 6757 - Family Savings Act of 2018

- Includes a series of reforms to make it easier for employers, especially small employers, to provide retirement plans to their employees.

- Includes reforms that make it easier for employees to participate in employer-sponsored retirement plans and individual retirement arrangements (IRAs).

H.R. 6756 - American Innovation Act of 2018

- Doubles the amount of start-up and organizational costs that can be expensed in the first year of operations.

- Provides start-up businesses more flexibility in attracting capital to fund their operations during the start-up phase exempting net operating losses and general business credits generated in the early years of a start-up business from the limitations on use that otherwise could apply.