Don’t Blame The Montgomery County Government for Increasing Property Taxes

One of the main concerns for residents of Montgomery County is the increasing property tax burden. The county and state government finance systems are so complex that it is easy for misconceptions to arise about how the property tax system in Texas works. Lawmakers in Austin know this, so they think they can get away with distorting the truth in their mailers and campaign talking points blaming local county officials for increasing property taxes. This has been evidenced in State Representative Mark Keough’s (HD 15) Republican Primary campaign for Montgomery County Judge.

According to a recent Montgomery County Courier article, "Desperate acts or strategic moves for county judge candidates down the stretch?", candidate for Montgomery County Judge Mark Keough “alleges county spending has increased 77 percent since 2010, resulting in a 133 percent increase in taxes during that time.” However, “Keough admitted that the 133 percent property tax revenue figure includes new property growth over the past seven years."

It's not clear how exactly Keough calculated a 77 percent increase in county spending since 2010, because a simple look at the Montgomery County Tax Office’s 2010/2011 and 2017/2018 Budget Highlights reveals that over the last seven years county government expenditures increased from $236,889,045 to $328,524,551, a 38.7 percent increase in county spending. Considering that the population the county government provides services to increased from 455,700 to 647,417 over that time (a 42 percent increase in county population), a 38.7 percent increase in county expenditures makes sense.

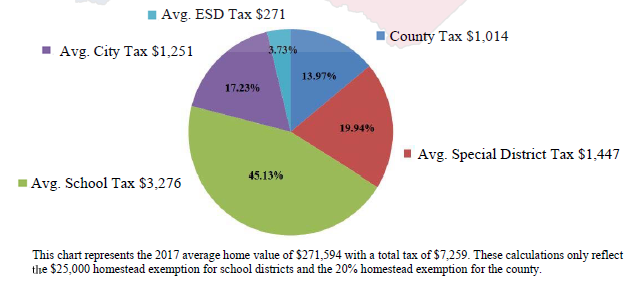

Additionally, the same county budget highlights reveal that the average total property tax paid by Montgomery County residents increased from $5,433 to $7,259 over the last seven years, a 33.6 percent increase. While a 33.6 percent increase in taxes over seven years is something to consider, it is nowhere near the 133 percent increase that Keough has been leading people to believe. However, the most disingenuous part of Keough’s allegations about property taxes is not his misrepresentation of the numbers, but his implication that the county government is the main entity causing property taxes to increase.

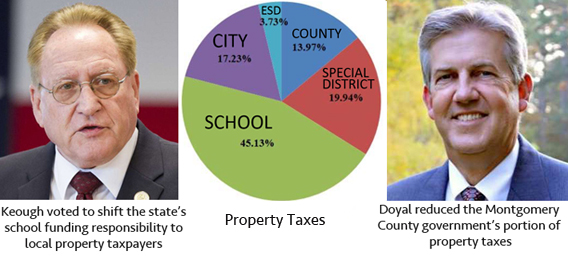

Keough has repeatedly utilized this false narrative in an attempt to place the blame for rising property taxes on his opponent in the Republican primary election for Montgomery County judge, the incumbent Judge Craig Doyal. Nothing could be further from the truth, because the county government and the Commissioners Court only have the power to affect the tax rate of a relatively small portion (13.97%) of the total property tax bill. The rest of property taxes and their tax rates are levied by separate entities, like local school boards (45.13%), city governments (17.23%), and special districts (19.94%).*

Representative Keough’s property tax narrative seems especially disingenuous when considering the ways in which he vs. Judge Doyal have actually affected Montgomery County property taxes in their time as elected officials.

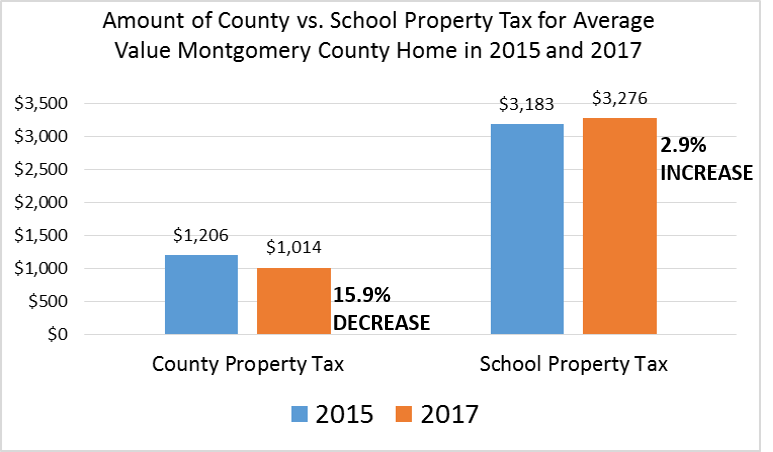

In Craig Doyal’s time as County Judge from 2015 to 2017, the average county tax DECREASED from $1206 to $1014, a 15.9% decrease led by Judge Doyal and the County Commissioners Court. Judge Doyal helped reduce the county budget by 5.6% in 2017, cutting wasteful government spending, and also maintained a AAA credit rating for Montgomery County to minimize the amount of tax dollars the county spend on interest payments.

On the other hand, during Mark Keough's time as a Texas state representative, he quietly voted to allow property taxes to INCREASE by shifting even more responsibility for public education funding from the state to local taxpayers. The state budget that Representative Mark Keough and law makers in Austin voted to pass at the end of the last legislative session states that it depends on property taxes going up by 7 percent the first year, and 6.8 percent the next.

"Property values, and the estimates of local tax collections on which they are based, shall be increased by 7.04 percent for tax year 2017 and by 6.77 percent for tax year 2018.”

So, in other words, the Texas State Legislature is depending on appraisal boards to raise home values and increase property taxes so they can afford their state budget.

That budget means the local school, or “ISD” portion of Montgomery County property taxes has the potential to increase by over 14%. In 2017, school taxes represented 45.13% of the amount billed to the average Montgomery County homeowner for property taxes. School taxes are, by far, the LARGEST slice of the residential property tax pie. Because the state cut its portion of funding for education, it is unlikely school boards will be able to lower their tax rates like the county government did in 2016, even when appraisals on home values go up.

It’s one thing to talk about cutting property taxes, but it’s another thing to actually do it. From examining how the candidates for Montgomery County judge have affected our property taxes in their time as elected officials, one thing is clear: Craig Doyal has reduced them, and Mark Keough voted to raise them.

This primary election cycle, concerned voters should try to avoid being influenced by candidates' self-serving political narratives, and focus on what candidates have done, said, and plan to do about the real issues facing residents of Montgomery County.

*Average percentages of the 2017 property tax bill of the average valued home in Montgomery County, according to the Montgomery County Tax Office’s 2017/2018 Budget Highlights insert.