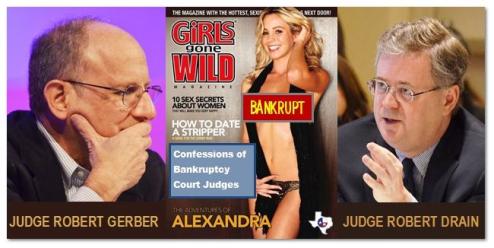

Girls Gone Wild Hits Bankruptcy Courts - Maybe it should be Bankruptcy Judges Gone Wild!

Is it Girls or Bankruptcy Judges that have Gone Wild?

Researching everything going on in relation to the bankruptcy series I have been writing can be pretty dry. However, recently on Bankruptcy Law Review, I came across something that is both interesting and revealing at the same time. It seems the company behind Girls Gone Wild (GGW) has been forced into the bankruptcy courts. The Chapter 11 case was filed in the Central District of California bankruptcy courts in Los Angeles. It begs the question, why didn't this go, like many other high profile bankruptcy cases, to the Southern District of New York (SDNY) courts. Perhaps "Girls Gone Wild" just hits a little too close to home in a district where it is more like "Judges Gone Wild!"

It actually makes sense that GGW would file their bankruptcy in the local courts. After all, they are a California corporation based in Santa Monica, CA. What doesn't make sense is, why are Texas based companies like Hostess, American Airlines and LyondellBasell getting hauled into the SDNY courts? Are Texas bankruptcy judges less competent than SDNY judges? Hard to believe given some of the antics we have seen from the SDNY courts in prior articles. More likely, the abusive law firms representing unsecured creditors in vexatious litigation actions against innocent bystanders know that judges like Gerber and Drain will simply look the other way while they engage in practices that, in any other scenario, could be called extortion.

The continued process of allowing these large cases to be centrally located in the SDNY courts is creating a incestuous, self-serving pool of financial predators, ambulance-chasing lawyers and complicit judges that is not good for anyone except the parties involved. Out of the chaos of these processes we have people getting rich while adding no real value to the business process and other people being financially destroyed through no fault or misdeeds of their own.

Girls Gone Wild earned its infamous reputation by stripping young girls. But perhaps the real scandal should be the federal bankruptcy judges stripping pensioners and shareholders of their financial assets!

The American Bankruptcy Institute has been conducting a series of panel hearings across the country. The goal is supposed to be to find ways to improve the process of Chapter 11 to make it better serve the businesses and people of our country. One topic I have not heard discussed is the process for selection of courts where cases are to be filed. Perhaps the ABI should take a look at this in the next panel discussion.

We will continue to dig deeper into the antics of these courts that are going wild with the law. There are real victims in these cases, and there will be more in the future if we do not find a way to stop the manipulation of our legal system to create personal gain for a very small number of people.

Over the past several months I have explored the issues with lawlessness in our federal government and in particular, the U.S. Corporate bankruptcy process (especially for cases in the Southern District of New York Bankruptcy Courts), in Parts 1-8 of the series. To recap:

The first part of the series, Chapter 11 Bankruptcy, A License to Steal, or Redistribute Wealth?, uncovered an underworld of law and questionable processes within our nation's bankruptcy system, described by court insiders as the "fox guarding the hen house" and rationalized with phrases like "melting ice cube" and "rotting fish". I ask whether the U.S. bankruptcy court system has become nothing more than a tool for lawyers and insiders to redistribute wealth to themselves and their cronies, and in the process, victimize pensioners and ordinary shareholders.

In Bankruptcy Courts Part 2 – The Fox is Guarding the Henhouse While the Farmer Sleeps, I question whether America's bankruptcy process is bankrupt after stopping by the National Conference of Bankruptcy Judges in San Diego. I discuss a phrase I heard quite frequently: “the fox is guarding the henhouse,” which is referring to a uniquely American practice where the management of the bankrupt company is left in charge of the company and its assets during the bankruptcy process.

In Bankruptcy Courts Part 3 - Hostess Bankruptcy: Unions, Management or Investment Bankers...Where's the Dough?, I examine the bankruptcy of Irving, Texas based company Hostess Brands, while continuing my investigation of New York's U.S. bankruptcy courts and the redistribution of wealth. I have a life-long predisposition to believe the unions are usually in the wrong. But is that the case in this situation?

In Bankruptcy Courts Part 4 - Fairness and Consistency Go Down the Drain, I speak to Judge Robert Drain who was the presiding bankruptcy judge of the Southern District of New York Bankruptcy Court that heard the Delphi Bankruptcy case. If a court isn't going be fair, it should at least be consistent, and I realized that Judge Drain's court is neither.

In Bankruptcy Courts Part 5 - Is Change in the Air for Bankruptcy Courts?, I visit the American Bankruptcy Institute's (ABI) Winter Leadership Conference in Tucson, Arizona to see if there is any change in the works for American bankruptcy courts.

In Bankruptcy Courts Part 6 - Much Needed Study to Reform Chapter 11 Underway, I further discuss the American Bankruptcy Institute's Commission to Study the Reform of Chapter 11 Bankruptcy by holding hearings about increasing problems and issues with the current Chapter 11 statute. However, is this just another case of foxes guarding the hen house or is a path to meaningful reform really underway?

In Bankruptcy Courts Part 7 - General Motors Revisited by Judge Robert Gerber... Oops, I discuss how the GM bankruptcy case has gone from "melting ice cube" to a messy mud puddle after an improper financial transfer was missed by Judge Robert Gerber’s bankruptcy court in the Southern District of New York. Did he get scammed by the Obama Administration, or was he asleep at the wheel?

In Bankruptcy Courts Part 8 - Vexatious Litigation and Abuse of Legal Process?, I examine the issue of being sued simply for buying or owning stock in a company. If allowed to continue, this process could undermine the very core of our financial investment industry. In the coming weeks, TexasGOPVote will bring you real stories from some of these real victims.

Comments

Join the Discussion on Facebook

Make sure to join in on the facebook discussion.