More Special Prosecutor Bills

After it was announced that the Commissioners Court is set to consider another round of special prosecutor payments this Monday, January 30, I began receiving many calls, asking for information, as well as my position on payments in the case against Texas Attorney General Ken Paxton. I have written about this multiple times, sharing my position, as well as my philosophy, so I'm happy to re-state where I stand in the matter.

After it was announced that the Commissioners Court is set to consider another round of special prosecutor payments this Monday, January 30, I began receiving many calls, asking for information, as well as my position on payments in the case against Texas Attorney General Ken Paxton. I have written about this multiple times, sharing my position, as well as my philosophy, so I'm happy to re-state where I stand in the matter.

As most of you are aware, the Collin County Commissioners Court has received bills throughout this process, including legal fees from a related civil case, in addition to the fees paid directly to the multiple special prosecutors. I have consistently voted "NO" to paying these bills, and will continue to do so, unless the legality and appropriateness of these charges has been tested in a higher court. My opposition to paying these bills is directly on behalf of the taxpayers that I represent, as a steward of your tax dollars, and has nothing to do with the personalities involved or the politics of the situation. I don't care which side of the "aisle" the defendant is on, OR if they are a friend or a foe, I am still opposed to these payments. In other words, it's NOT about the defendant, but rather, it's about DEFENDING the TAXPAYERS.

In any legislative body, there will always be diversity, bringing together the collective experience and perspective of its members. There have been several times when one of my colleagues has shed new light on a topic being considered by the court. These diverse perspectives can strengthen the body, as well as its decisions. While I respect my colleagues on the court, our own Collin County judiciary, and the authority of Judge Gallagher, the District Judge from Tarrant County overseeing the Paxton case, I continue to question the appropriateness and legitimacy of these expenditures, due to what I believe is an arbitrary and capricious hourly rate that was awarded, set by Collin County District Judge Scott Becker, who originally appointed the prosecutors in the case. The rate set by Judge Becker is in direct conflict with the Collin County Indigent Defense Policy, as current law makes it clear that attorneys pro tem are to be paid in the same manner in which appointed Indigent Defense attorneys are paid.

- Texas Code of Criminal Procedure Art. 2.07(c) governing the appointment of an attorney pro tem (pro tempore or temporary) provides, “(c) If the appointed attorney is not an attorney for the state, he is qualified to perform the duties of the office for the period of absence or disqualification of the attorney for the state on filing an oath with the clerk of the court. He shall receive compensation in the same amount and manner as an attorney appointed to represent an indigent person.”

- Therefore, the fee schedule to be used in determining the compensation of special prosecutors may be found in the Collin County Indigent Defense Plan, which indicates the maximum we can authorize, by law, for the payment of pre-trial preparation is $1,000, plus a discretionary amount not to exceed another $1,000 - for a total of $2,000 thus far. During the trial, compensation is set at $1,000 per day, with no variance.

Our Indigent Defense policy also requires that appointed attorneys live in Collin County, have their principal practice in Collin County, or conduct 80% of their practice in Collin County, as well as there being no provisions for interim payments - meaning they shall not be paid until the case is over. So at this time, not only have we been paying far above the fee schedule that was drafted by our own Collin County Board of District Judges, we have also paid for travel, meals and lodging, as well as made interim payments, for which there is no provision in the plan. Interestingly enough, the policy has even been modified since the special prosecutors were originally hired by Judge Becker, however the arrangements made with the special prosecutors are still not within the scope of the policy.

While I may read AG opinions and case law on the topic, I am of the mindset that they are still opinions, and judicial process, including appeals and rulings of a higher court, take precedence. From the beginning, I have advocated for the Commissioners Court to contest these orders by appealing to the Fifth District Court of Appeals. In doing so, we would have legally “tested” the legitimacy of the orders – and if the court didn’t agree with us, we would then have been able to SHOW the taxpayers of Collin County that we have exhausted all of our options, prior to paying the bills. While the rule of law should certainly be followed, this paradox that we find ourselves in is precisely the reason we have a court system - to interpret and clarify the law, and the merits of the dilemma in question, according to the law.

I believe it is my fiduciary duty, as an overseer of the county budget and your representative, to appeal to a higher court, and to determine the validity and appropriateness of these (and future) payments, which I believe are out of compliance with state law, as well as the county's policy. I have even go so far as to obtain an independent legal opinion, at my OWN expense, regarding the grounds upon which to appeal to a higher court. For the record, the opinion I received supports my reasoning, and contradicts an opinion that was obtained by the court from another law firm. But back to my point, we can read opinions all day long, however, until this issue is tested and decided in an appellate court, we are left to wonder if we are legally obligated to pay these excessive invoices.

Even if I stand alone, I remain steadfast in my opposition, including paying for the defense of the special prosecutors in the civil case, unless I am compelled by a higher court to pay them. Additionally, I believe that the civil case filed by a local Collin County resident for temporary relief would not have even been necessary if the Commissioners Court had appealed these orders to pay ourselves. This would have, in fact, also answered the question our local citizen is asking, and prevented us from having to pay an additional $100K+ in legal costs. The case brought forth by this local citizen was dismissed, because of a "lack of standing" - therefore our only recourse is for the court to challenge the bills ourselves. Such a challenge will likely cost the taxpayers another $100K, but before I can approve ANY payments, I need to know that the expenditure is appropriate and legal, and that it follows the law, previously set forth in statute.

I am also deeply disturbed that as the legislative body responsible for budgeting and oversight 90% of your county tax dollars, we are, in effect, writing a blank check, and do not have any control over these massive costs. How do I effectively carry out the duties of my own office in budgeting if an individual judge can unilaterally bind the county to MILLIONS of your tax dollars? I firmly believe that if Judge Becker had been legally required to go back to the Board of District Judges (who created the policy) to ask for a variance, that the $300 per hour rate would have been soundly rejected, and that alternative, more appropriate suggestions would have been considered. (Texas Legislature: please take note.) But since no other options for prosecution were considered (such as having a neighboring District Attorney's office(s) fulfill the role of special prosecutor), the citizens of Collin County were placed on the hook for paying these massive fees, unless we appeal them to a higher court.

Furthermore, I have grave concerns about how this one case may ultimately cause the costs of indigent defense to rise, further burdening the taxpayers. We are constitutionally mandated to fund Indigent Defense - and again, the highest amount mentioned in our current Indigent Defense policy for a First Degree Felony is $1,000 pre-trial preparation, $1,000 per day at trial plus a $1,000 discretionary adjustment (not to exceed $1,000). So, for instance, let's say that we had an indigent citizen arrested on a First Degree Felony, who was eventually convicted. When that citizen sees that the county paid exponentially more than was paid to their own attorney for legal defense, as well as DOUBLE the hourly rate for a CAPITAL MURDER DEFENDANT - and to multiple out-of-town attorneys pro tem - to prosecute a fairly simple case, you can imagine the implications. The county could suddenly be faced with a claim that we didn't adequately fund an indigent citizen's defense, and that citizen could possibly then request a new trial, costing the taxpayers even more. From there, you can see the writing on the wall - and we would face a massive increase in our budget to defend our indigent population from here on out.

I've asked this rhetorical question in court several times, during our discussions... What if this exact situation were replicated in a small, rural Texas county such as San Jacinto County - or Hays County? Answer: It would completely and utterly bankrupt the county. Possibly, they could double, triple or quadruple the tax rate for the following fiscal year - but I ask you, is it right to over-burden the taxpayers of an individual county in this manner? Especially when there are other means to appoint special prosecutors through working with other local District Attorney's offices. What if the projected fees were not $2M, but $20M, or more? Just because we are a large, generally affluent urban county, should our citizens be more "on the hook"? If so, then the law is not being applied evenly to all Texans. What figure would be considered "too much" for the citizens to bear - and how do you determine that figure? If this situation is not addressed legislatively, it WILL happen again somewhere. While we must be careful not to hamstring justice, I believe it is our collective duty, as your elected officials (including the Commissioners Court as well as the Board of District Judges who control roughly 10% of the county budget), to ensure that county operations are run as efficiently as possible - and we should make every effort to use your county tax dollars wisely.

You may also remember that in October, I also brought this additional information to you:

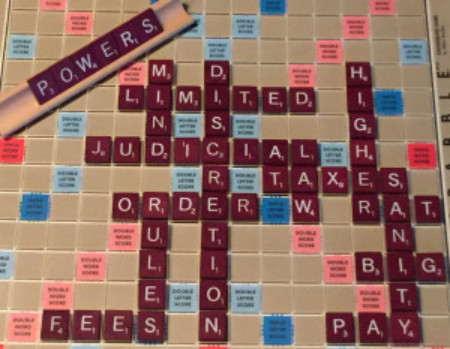

1. Collin County already has a legal opinion regarding our position on the separation of powers between a District Court and a Commissioners Court ON FILE with the Texas Supreme Court. While the court case involves another legal matter, the key point is that, THIS legislative body filed a detailed Amicus Curiae Brief ("friend of the court" position paper which lays out legal justification and reasoning), prepared by our own outside counsel, stating the following position - summarizations / abbreviations indicated by [*italicized text]:

- Collin County [*disagrees with the previous decision to allow] a District Court to impermissibly overreach into the legislative budgeting functions of the Commissioners Court in instances when the District Court simply disagrees with the financial decision of the Commissioners Court [*specific case referenced]. Although District Courts have limited powers to exercise supervisory authority over actions of a Commissioners Court, in this instance the undisputed facts reflect no illegal, unreasonable or arbitrary conduct to support the exercise of such authority.

- Unwarranted interference by the judiciary into fiscal decisions made by the Commissioners Court threatens the separation of powers between the judicial and legislative branches of county government. Such interference erodes the powers and statutory duties of the Commissioners Court regarding the control and expenditure of County funds, and if such interference is allowed to stand, could plausibly result in a dramatic shift power to the judicial branch.

- Moreover, such actions remove the taxpayers from having any input or voice in the political process. Rather, the decisions of the District Court, as evidenced in this instance, were made at the District Court’s sole discretion and without any rights afforded to the public to participate. Further, the Court of Appeals decision conflicts with legal precedent, including opinions of this Court.

My duty as your County Commissioner is to honor my oath, and to faithfully execute the duties of my office and uphold the law. During my campaign, I promised to represent you, the taxpayers of Collin County, and to do all that I could to ensure that your tax dollars were used efficiently, and that I would conduct your public business with transparency and accountability. Again, my position has not changed, and I will continue to vote "NO" on these excessive fees, unless we are compelled by a higher court to pay them.

Regardless of your position on the issue, thank you for taking an interest in your county government. My door remains open, and I look forward to the final resolution of this case. If you would like to join us in person, the Commissioners Court will meet in open session at 1:30 pm on Monday, January 30, 2017 at the Jack Hatchell Administration Building, 4th Floor; 2300 Bloomdale Rd. McKinney, TX 75071. To tune in online, please visit our website HERE.