Immigration Reform: Let's Be Sensible

I learned a valuable political lesson in a very unlikely place last week—my news reporting and writing class. Yes, I, the Republican, learned a political lesson in a journalism school.

I learned a valuable political lesson in a very unlikely place last week—my news reporting and writing class. Yes, I, the Republican, learned a political lesson in a journalism school.

Our instructor was explaining we actually do have to be politically neutral when reporting and try to get not only both sides of an issue, but also everything in between.

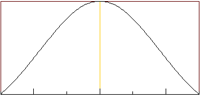

His example was Arizona’s SB 1070. He drew a graph on the board that had 10-percent of the population listed as racist supporters of the law and 10-percent listed as amnesty-loving detractors. The other 80-percent of the population remained unlabeled.

His graph proved a valid point: Most Americans don’t want extreme immigration reform on either side of the political spectrum. Very few people I’ve heard support SB 1070 support the law solely because they don’t like Mexican immigrants in the country, and I have yet to hear a lot from amnesty-supporters—even at my large liberal university.

The media has centered America’s immigration debate around extremes, but few people have focused on reform that meets the two sides in the middle. Few people focus on reform that is sensible.

With mass deportation of illegal immigrants, our country would be spending ridiculous amounts of money on hunting down people.

By allowing amnesty, our country would gain thousands of new citizens we would have to take care of financially through government-run programs.

We’d be watching our taxes and our deficit rise either way—definitely not a fiscally conservative thing to do.

Even America’s “Toughest Sheriff,” Maricopa Country Sheriff Joe Arpaio supports immigration reform and thinks it should be less expensive and easier to immigrate to the country.

Sensible immigration reform like Texas businessman Norman Adams’ platform resolution is exactly what this country needs. Sure, it’s anything but simple, but neither is the immigration problem. Sensible reform is a complex solution to a complex problem.

As Americans, we’re all part of a big melting pot. Yes, we’re all immigrants. There’s nothing wrong with immigrating to this country. We just have to make sure we’re fair and do so legally.

Comments

THE UNDOCUMENTED IMMIGRANTS ARE PAYING MORE TAXES THAN YOU THINK

THE UNDOCUMENTED IMMIGRANTS ARE PAYING MORE TAXES THAN YOU THINK!!!!!!!!!!!!!!

Eight million Undocumented immigrants pay Social Security, Medicare and income taxes. Denying public services to people who pay their taxes is an affront to America’s bedrock belief in fairness. But many “pull-up-the-drawbridge” politicians want to do just that when it comes to Undocumented immigrants.

The fact that Undocumented immigrants pay taxes at all will come as news to many Americans. A stunning two thirds of Undocumented immigrants pay Medicare, Social Security and personal income taxes.

Yet, nativists like Congressman Tom Tancredo, R-Colo., have popularized the notion that illegal aliens are a colossal drain on the nation’s hospitals, schools and welfare programs — consuming services that they don’t pay for.

In reality, the 1996 welfare reform bill disqualified Undocumented immigrants from nearly all means tested government programs including food stamps, housing assistance, Medicaid and Medicare-funded hospitalization.

The only services that illegals can still get are emergency medical care and K-12 education. Nevertheless, Tancredo and his ilk pushed a bill through the House criminalizing all aid to illegal aliens — even private acts of charity by priests, nurses and social workers.

Potentially, any soup kitchen that offers so much as a free lunch to an illegal could face up to five years in prison and seizure of assets. The Senate bill that recently collapsed would have tempered these draconian measures against private aid.

But no one — Democrat or Republican — seems to oppose the idea of withholding public services. Earlier this year, Congress passed a law that requires everyone who gets Medicaid — the government-funded health care program for the poor — to offer proof of U.S. citizenship so we can avoid “theft of these benefits by illegal aliens,” as Rep. Charlie Norwood, R-Ga., puts it. But, immigrants aren’t flocking to the United States to mooch off the government.

According to a study by the Urban Institute, the 1996 welfare reform effort dramatically reduced the use of welfare by undocumented immigrant households, exactly as intended. And another vital thing happened in 1996: the Internal Revenue Service began issuing identification numbers to enable illegal immigrants who don’t have Social Security numbers to file taxes.

One might have imagined that those fearing deportation or confronting the prospect of paying for their safety net through their own meager wages would take a pass on the IRS’ scheme. Not so. Close to 8 million of the 12 million or so illegal aliens in the country today file personal income taxes using these numbers, contributing billions to federal coffers.

No doubt they hope that this will one day help them acquire legal status — a plaintive expression of their desire to play by the rules and come out of the shadows. What’s more, aliens who are not self-employed have Social Security and Medicare taxes automatically withheld from their paychecks.

Since undocumented workers have only fake numbers, they’ll never be able to collect the benefits these taxes are meant to pay for. Last year, the revenues from these fake numbers — that the Social Security administration stashes in the “earnings suspense file” — added up to 10 percent of the Social Security surplus.

The file is growing, on average, by more than $50 billion a year. Beyond federal taxes, all illegals automatically pay state sales taxes that contribute toward the upkeep of public facilities such as roads that they use, and property taxes through their rent that contribute toward the schooling of their children.

The non-partisan National Research Council found that when the taxes paid by the children of low-skilled immigrant families — most of whom are illegal — are factored in, they contribute on average $80,000 more to federal coffers than they consume. Yes, many illegal migrants impose a strain on border communities on whose doorstep they first arrive, broke and unemployed.

To solve this problem equitably, these communities ought to receive the surplus taxes that federal government collects from immigrants. But the real reason border communities are strained is the lack of a guest worker program.

Such a program would match willing workers with willing employers in advance so that they wouldn’t be stuck for long periods where they disembark while searching for jobs. The cost of undocumented aliens is an issue that immigrant bashers have created to whip up indignation against people they don’t want here in the first place.

With the Senate having just returned from yet another vacation and promising to revisit the stalled immigration bill, politicians ought to set the record straight: Illegals are not milking the government. If anything, it is the other way around.

The Undocumented Immigrants pay the exact same amount of taxes like you and me when they buy Things, rent a house, fill up gas, drink a beer or wine, buy appliances, play the states lottery and mega millions . Below are the links to just a few sites that will show you exactly how much tax you or the Undocumented Immigrant pays , so you see they are NOT FREELOADERS, THEY PAY TAXES AND TOLLS Exactly the same as you, Now if you take out 10% from your states /city Budget what will your city/state look like financially ?

Stop your folly thinking , you are wise USE YOUR WISDOM to see the reality. They pay more taxes than you think, Including FEDERAL INCOME TAX using a ITN Number that is given to them by the IRS, Social Security Taxes and State taxes that are withheld form their paychecks automatically.

Taxes, paid by You & the Undocumented are the same in each state check your state : http://www.taxadmin.org/fta/rate/sales.html

GAS Taxes paid by you & the Undocumented are the same. Go to and check out your states tax; http://www.gaspricewatch.com/usgastaxes.asp

Cigarette Taxes paid by you & the Undocumented are the same, check this out in : http://www.taxadmin.org/fta/rate/cigarett.html

Clothing Sales Taxes, are the same paid by you & the Undocumented Immigrant; http://en.wikipedia.org/wiki/Sales_taxes_in_the_United_States

City Taxes, are the same paid by you or the Undocumented, since he pays rent and the LANDLORD pays the city : http://www.town-usa.com/statetax/statetaxlist.html

Beer Taxes, are the same paid by you or the Undocumented: http://www.taxadmin.org/fta/rate/beer.html

TAX DATA : http://www.taxfoundation.org/taxdata/show/245.html

About your recent blog

I love the way you present the facts in this article. There is so much missguided comments from Republican as Senator Tancredo. Which exploit hate and anti-immigrant sentiment from their constituences.

Congrats!

Jose Chavez

I love it. It is absolutely

Facebook Comments

Make sure to check out the comments on Facebook.

Is this your idea of being pro immigrnant?

That's very big of you. Really.