Congressman Johnson Introduces Common-Sense Medicare Part A Reform

Congressman Scott Perry (R-PA) and I introduced common-sense Medicare reform legislation, H.R. 3498, so seniors can have the freedom to make their own healthcare decisions and to opt-out of the government-run health program for seniors.

Congressman Scott Perry (R-PA) and I introduced common-sense Medicare reform legislation, H.R. 3498, so seniors can have the freedom to make their own healthcare decisions and to opt-out of the government-run health program for seniors.

As folks continue to see their healthcare options diminished by ObamaCare, it’s critical to find ways that allow a return to choice and freedom in health care. This common-sense bill does just that, it truly tells seniors, "if you like your current coverage, you can keep it" without risk of losing other important benefits like social security. If folks like Warren Buffett or Ross Perot want to opt-out of Medicare Part A because they don’t want or need a government entitlement paying for their health care, we should let him! Seniors should have the freedom to say "thanks, but no thanks" if they want to keep their current coverage.

“Americans should have the right to choose a healthcare plan that fits their needs, rather than be tied to a government-run system that doesn’t meet their unique medical requirements. American seniors should have the choice to decide what plan works best for their family. Medicare also desperately needs to be reformed in order to ensure this program is viable for current and future generations. This bill takes off some of the budgetary pressure from Medicare to help ensure its long-term sustainability for all seniors,” said Congressman Perry.

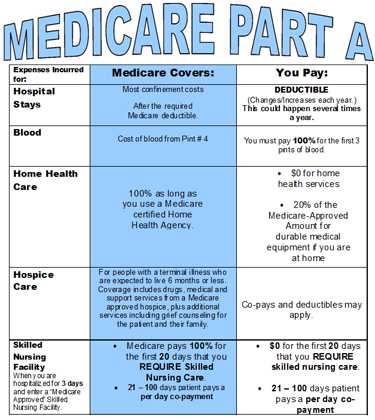

H.R. 3498 will help reduce burdensome regulations in the Medicare program that restricts America’s seniors from truly being able to keep their current health coverage. This bill allows individuals to voluntarily opt-out of Medicare Part A when they become eligible for the benefit. Today, you can choose not to enroll in Medicare Part B or Part D, but not for Part A unless you give up your Social Security benefits too.

A free society is based on individual choice and personal responsibility. Medicare Part A makes it illegal for seniors to have a choice. Our bill changes that.

Additionally, the bill will allow seniors with a Health Savings Account (HSA) and qualified High Deductible Health Plan (HDHP) to continue contributing to their HSA with pre-tax dollars after they turn 65. Under current law, seniors who have an HSA and turn 65 are no longer eligible to contribute pre-tax dollars to their HSA.

Comments

Join the Discussion on Facebook

Join the discussion on Facebook.