Americans For Tax Reform: Indexing Capital Gains Will Help Middle-Class Families

I, along with 20 senators, sent a letter yesterday to Treasury Secretary Steven Mnuchin, urging the Treasury Department to index the capital gains tax to inflation.

I, along with 20 senators, sent a letter yesterday to Treasury Secretary Steven Mnuchin, urging the Treasury Department to index the capital gains tax to inflation.

"The United States economy has experienced historic levels of growth as a result of Congress and the current administration's policies such as the Tax Cuts and Jobs Act," we wrote. "Implementing a policy of indexing capital gains to inflation will help to perpetuate these successes by encouraging savings, investment, and innovation so that everyday Americans can continue to enjoy better lives and livelihoods."

Americans For Tax Reform issued a statement applauding the letter I led, noting the importance of indexing capital gains in order to build on the economic growth brought about by the Tax Cuts and Jobs Act:

"All taxpayers appreciate Senator Cruz's leadership in the fight to stop the government from taxing inflation. This has gone on too long. Taxing inflation is wrong and unfair," said Grover Norquist, President of Americans for Tax Reform. "The Trump administration has the power to correctly define gains as real gains and not inflation gains."

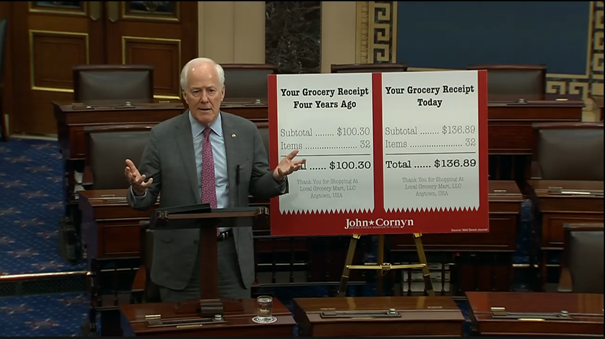

The letter was signed by Sens. Kevin Cramer (R-N.D.), Jim Inhofe (R-Okla.), Marsha Blackburn (R-Tenn.), Thom Tillis (R-N.C.), Pat Toomey (R-Pa.), John Boozman (R-Ark.), James Lankford (R-Okla.), Steve Daines (R-Mont.), John Barrasso (R-Wyo.), John Kennedy (R-La.), Mike Braun (R-Ind.), Ron Johnson (R-Wis.), Cindy Hyde-Smith (R-Miss.), John Cornyn (R-Texas), Rand Paul (R-Ky.), Richard Burr (R-N.C.), Roy Blunt (R-Mo.), Roger Wicker (R-Miss.), Jim Risch (R-Idaho), and Ben Sasse (R-Neb.).

Read the full letter here and below.

July 29, 2019

The Honorable Steven T. Mnuchin

Secretary of the Treasury

U.S. Department of the Treasury

1500 Pennsylvania Avenue, NW

Washington, D.C. 20220

Dear Secretary Mnuchin:

We urge you to use your authority to eliminate inflationary gains from the Department of the Treasury's calculation of capital gains tax liability. The United States economy has experienced historic levels of growth as a result of Congress and the current Administration's policies such as the Tax Cuts and Jobs Act. Implementing a policy of indexing capital gains to inflation will help to perpetuate these successes by encouraging savings, investment, and innovation so that everyday Americans can continue to enjoy better lives and livelihoods.

Over the last two-and-a-half years, the United States has experienced a surge in investment, jobs, and wages along with a stark decrease in unemployment and joblessness. Thanks to the current Administration's policies, business investment went from a disappointing -0.6 percent in 2015, to 7 percent in 2018. In spite of forecasts by the Congressional Budget Office in August 2016 that only 24,000 jobs would be created per month in 2018, pro-growth policies changed that trajectory and affected an actual average monthly creation of 223,000 jobs. As a result, jobless claims and unemployment reached 50-year lows. Rather than resting on these accomplishments, however, Congress and the Administration must both continue working to reduce impediments to economic growth.

Utilizing executive authority to define cost basis in a way that would remove the unfair inflation tax on savings and investment would be one such positive, pro-growth change the Administration could undertake. Currently, the methodology Treasury employs to calculate capital gains ignores gains resulting from inflation and ultimately hampers economic growth. When a taxpayer sells a capital asset, they pay taxes on their gains-the difference between the basis and the sale price. Under current rules, Treasury determines the basis by looking at the sticker price at the time of purchase without consideration of the inflation-adjusted cost of the asset in today's dollars.

This means, in some cases, a taxpayer can face a tax liability even after suffering an actual loss. Imagine, for example, a taxpayer who purchased one share of Coca-Cola stock in 1998 for $32.38. If they sold the stock earlier this year at $48.13, they would have a nominal gain of $15.76 and be taxed $3.75. The inflation-adjusted basis in today's dollars, however, would be $50.50. That means the taxpayer would have to pay $3.75 in taxes on a $2.38 loss. Even when a taxpayer experiences a real gain, the effective capital gains rate can easily double the statutory rate passed by Congress.

This treatment punishes taxpayers for the mere existence of inflation and is inherently unfair. Other tax provisions such as individual income brackets are rightly adjusted for inflation annually. Capital gains ought to receive the same equitable treatment.

In addition to maintaining equitable treatment, this action would have significant economic benefits. Indexing capital gains to inflation would unlock capital for investment, increase wages, create new jobs, and grow the economy, benefiting Americans across all income levels. Any decrease in the effective tax rate on capital gains incentivizes investors to realize gains on their investments, which opens up those dollars to new, more efficient allocations. According to findings by the nonpartisan Tax Foundation, the tangible result would be approximately $22 billion in added value to the American economy over the long run-a gain that would be realized by American workers through more jobs and higher wages. The change would increase after-tax incomes by 0.2 percent on average and create an additional 21,800 full-time equivalent jobs.

Congress and the administration have made tremendous progress since 2017 in reducing tax and regulatory burdens that have stood in the way of a resilient American economy. Indexing capital gains to inflation is another clear and sensible step on this path, and we encourage you to use your authority to effect this change.