Cornyn Op-Ed: Tax Reform to Put More Money into Your Pockets

Texas families and small businesses really understand what’s at stake, because they’re the ones getting slammed by our current system.

I authored the following op-ed in the San Antonio Express-News over the weekend on how the principles laid out in the Republican framework for tax reform would benefit Texans:

I authored the following op-ed in the San Antonio Express-News over the weekend on how the principles laid out in the Republican framework for tax reform would benefit Texans:

Not long ago, our president came before the American public and was blunt about the state of the federal tax code in this country. It’s “rigged,” he said loudly. The code “makes no sense” and “has to change.” He called on Congress to “simplify the system. Get rid of the loopholes,” and “lower the corporate tax rate” — one that ranks among the highest in the industrialized world.

Although the words sound familiar, the president who delivered them might not be the one you’re thinking of: They’re from Barack Obama, during his 2011 State of the Union address.

Now, fast-forward a few years, and a new president from a different party is saying much the same thing. President Donald Trump has called our tax code a “relic” and a “colossal barrier standing in the way of America’s economic comeback.” He’s right, of course, and so was President Obama. Tax reform doesn’t have to be partisan. In fact, it shouldn’t be, because the ramifications are much more than political.

They’re personal. Texas families and small businesses really understand what’s at stake, because they’re the ones getting slammed by our current system.

Take Lisa Fullerton, for example, who owns a small company in San Antonio called A Novel Idea. Fullerton is an accountant with 33 years of experience who used to handle her business’s tax compliance in-house. Eventually, though, the code became too complex and enforcement too punitive — she could no longer take the risk. She says that outsourcing tax and employment functions now costs her business roughly $280,000 more per year than it did in 2000.

Fullerton is far from the only San Antonian who’s frustrated. Darryl Lyons, head of Pax Financial Group, is harmed each year by the “pass-through” taxes on his small-business income, which he says hampers his ability to save money for business emergencies and pay off debt. As the Express-News reported, he’s joined by people like Bill Cox, who’s been manufacturing screw machine components in San Antonio since 1956 but, weighed down by capital costs, struggles to purchase necessary equipment. And Louis Barrios, for whom lower tax rates could balance out rising food costs he’s incurring at his Tex-Mex restaurants across the city.

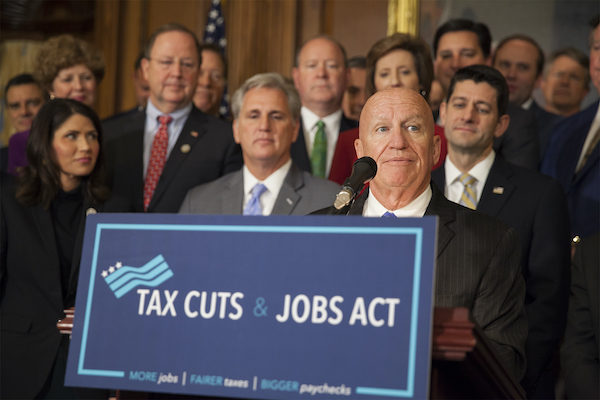

Thankfully, relief is on its way. Two weeks ago, a group led by House Speaker Paul Ryan, Treasury Secretary Steve Mnuchin and U.S. Rep. Kevin Brady of Texas released a unified framework that contains core principles for reform. Among them are a simplified rate structure, the elimination of the alternative minimum tax and many itemized deductions, and incentives for companies to keep jobs on American soil. And the framework recommends what’s widely agreed-upon as overdue: lowering our uncompetitive corporate rate so that Texas small businesses and workers are no longer at a disadvantage.

The framework is just the first step. Next week, the Senate will take the second when we consider a budget that lays the foundation for our reform bill. The tax-writing committees in both the House and the Senate will then get to work, with input and amendments from both sides of the aisle. The result will be a tax system ideally made better for all.

It’s true that we’re divided on many issues in America today. But as President Trump’s and Obama’s statements suggest, tax reform doesn’t have to be one of them. Everyone — at one time or another — feels the pinch and therefore stands to benefit. It’s time to take money out of Washington’s pocket and put it back in yours.