Detroit Falls Victim to Super Massive Blue Hole - Will Houston be Far Behind?

In 2011, Debbie Georgatos coined the phrase "Super Massive Blue Hole" to define the effect on cities that are controlled over long periods of time by liberal Democrat governments and policies. She named Detroit as the poster child of this effect. The phrase drew high-profile criticism from liberal news commentators Rachel Maddow and Anderson Cooper. It now appears her thoughts have become reality as Detroit recently became the largest city in our nation to file for debt relief under federal bankruptcy laws.

While researching my series on Bankruptcy Courts, I looked into this case along with the City of Stockton, CA bankruptcies. It made me wonder if Georgatos' statement was coming to reality sooner than she had expected. It is probably a good thing that Judge Robert Gerber was not handed this case as he might allow greedy New York lawfirms to sue the voters of Detroit like he is allowing the lawsuits against shareholders in the LyondellBasell case. Now I know you can't sue voters, but some of these bankruptcy lawyers get pretty creative in their "Clawback" lawsuits. Take a look at this article in Bankruptcy Law Review.

Georgatos made the statement to try and stir Dallas residents to not follow the path of other Democrat controlled cities like Detroit. "We don't want Dallas County to become the super massive blue hole," she said, "because we know what that looks like, it's called Detroit."

Which leads me to my question... With Detroit filing bankruptcy because of massive debt and pension obligations, can the City of Houston be very far behind? There are a lot of similarities between the financial conditions of Detroit and Houston. But there are also some big differences.

To drill down into this topic, I spoke with Houston City Controller candidate Bill Frazer. Frazer is a CPA and former president of the Houston CPA Society. He also served on the board of the Texas Society of CPA's.

Frazer pointed out that among the major differences between these two cities is Houston has a booming oil business and is experiencing a massive in-migration. This is in stark contrast to Detroit's struggling auto industry and the massive migration of people and business exiting their city. "Detroit is void of commercial growth," Frazer said. "People have given up 'Hope'".

Frazer put together some numbers for me to share with you comparing and contrasting the financial conditions of Detroit and Houston. Keep in mind the relative populations of the two cities. Detroit has about 685,000 people compared to Houston's population of around 2.1 million people.

OTHER POST EMPLOYMENT BENEFITS (OPEB)

Detroit has been in decline for a long time and apparently has made significantly more promises to retirees for health insurance coverage than Houston. For example:

• Houston’s cost of retiree health insurance was approximately $62 million for fiscal year ended June 30, 2012, the latest year available.

• Detroit’s annual expense is approximately $200 million a year.

The actuarially determined amount of future payments, in today’s dollars for OPEB:

• Houston - $1.03 billion

• Detroit - $5.7 billion

RETIREMENT BENEFITS

Total Pension Obligations:

• Detroit

o Unamortized Actuarial Accrued Liability (UAAL) - $3.5 billion

o IOU’s issued by the city to “fund” annual contributions - $0.1 billion

o Pension Obligation Bonds - $1.43 billion of Total liability - $5.030 billion

• Houston

o Unamortized Actuarial Accrued Liability (UAAL) - $2.57 billion

o IOU’s issued by the city to “fund” annual contributions - $0.969 billion

o Pension Obligation Bonds - $0.608 billion

o Total liability - $4.144 billion

Pension Funding (a measure of how each city has fared in actually making required annual contributions)

• Detroit - 92.4% funded

• Houston – 76.2% funded

OTHER FACTORS

A measure of Detroit’s inefficiency is the ratio of “public safety” employees it has (to population) compared to Houston.

• Detroit – 16.6 public safety workers per thousand

• Houston – 10.15 per thousand

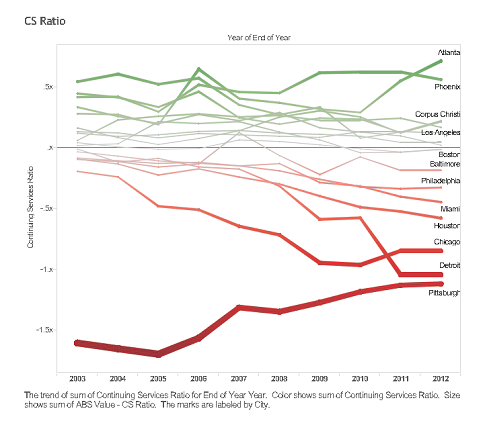

Click here for full size chart

Continuing Services Ratio – this is the measure of how much in Unrestricted Net Assets a city has to cover annual operating expenses. "Think about that savings account you have in case you lose your job," Frazer explained. "You might like to have a few months’ of living expenses in the bank. Negative Unrestricted Net Assets is a measure of how much debt you have that essentially paid for current operating expenses. It’s okay to have it sometimes, particularly after several years of recession. But Houston has had it 10 years running. We have over a half a year’s operating expenses in negative unrestricted net assets."

Click Here for Full Size Chart

At the end of our discussion Frazer noted, "It’s important to note that Houston is NOT going to go into bankruptcy because we have too much good going for us and I’m confident the good citizens of this city will come together and make hard decisions that will drive us farther down the road to becoming what we are capable. There’s no reason we can’t be the number one center for 'commerce' in the US, if not the world."

Frazer said the top priority for protecting Houston's financial position is to fix our pension issues. "They’re too rich, for some," Frazer explained, "but the primary problem is we haven’t been paying based on promises made, and the amount of debt as a result is overwhelming. We also take ALL responsibility for lack of investment performance, guaranteeing an 8.5% return on investments. As a result, no matter what we do otherwise, we need to convert to a defined contribution plan or hybrid."

Frazer warned that Houston's Unfunded Actuarial Accrued Liability (UAAL) will increase substantially if it were to lower these estimated returns from 8.5% to 7% or less as is being done by Detroit and other cities.

Houston has been fortunate to not have been under the exclusive leadership of Democrats unlike Detroit which hasn't seen a Republican mayor since 1957. However much damage has been done by free-spending, union-supporting Democrats like mayors Lee P. Brown, Bill White and Annise Parker. Parker also served as City Controller under Mayor White and knows full well where our pension obligations and debts are taking this city.

Will Houston get sucked into the Super Massive Blue Hole like Detroit and other Democrat led cities? Or will we do what Texans do? Will we recognize our problems and tackle them straight on? That is, after all, the Texan way of "fixin'" things!

Comments

Join the Discussion on Facebook

Join the Discussion on Facebook