Immigrant and Native Consumption of Means‐Tested Welfare and Entitlement Benefits in 2020

Total government spending on the welfare state amounted to about $2.6 trillion in 2020. In that year, the federal government spent roughly $2.4 trillion on welfare and entitlement programs, an amount equal to approximately 37 percent of all federal outlays. About $1.8 trillion of federal expenditures went to Social Security and Medicare, and the other roughly $600 billion funded means‐tested welfare benefits. The states spent an additional $229 billion on means‐tested welfare programs.

Based on data from the Survey of Income and Program Participation, we find that immigrants consumed 27 percent less welfare and entitlement benefits than native‐born Americans on a per capita basis in 2020. Immigrants were 14.6 percent of the U.S. population and consumed just 11.1 percent of all means‐tested welfare and entitlement benefits in 2020. By comparison, immigrants consumed 21 percent less welfare and entitlement benefits in 2016 and 28 percent less in 2019. From 2016 to 2020, the underconsumption of welfare by immigrants relative to native‐born Americans widened by about 6 percentage points. From 2019 to 2020, the gap shrank only slightly, by 0.6 percentage points.

Background

Immigrant consumption of welfare benefits has been a contentious policy issue for decades. This brief updates previous Cato policy briefs on immigrant welfare consumption in order to supply more up‐to‐date information to policymakers and the public.1 The federal government spent roughly $2.4 trillion on welfare and entitlement programs in 2020, an amount equal to approximately 37 percent of all federal outlays. That is lower than in 2019, when the share of federal spending on welfare amounted to 51 percent of total outlays. The change is primarily due to the massive $2.1 trillion increase in total federal spending in 2020 over 2019, much of it in response to the COVID-19 pandemic, which boosted federal welfare spending by around $150 billion.2 About $1.8 trillion of those expenditures went to Social Security and Medicare, whose intended beneficiaries are the elderly, while the other roughly $600 billion went to means‐tested welfare benefits, whose intended beneficiaries are the poor. The states spent an additional $229 billion on means‐tested welfare benefits.3

Means‐tested welfare programs are intended to aid the poor of any age. Eligibility for those programs and the value of their benefits are based on a variety of factors, including the recipient’s immigration status, income, and employment. For the purposes of this brief, means‐tested programs include Medicaid, the Supplemental Nutrition Assistance Program (SNAP), Supplemental Security Income (SSI), Temporary Assistance for Needy Families (TANF), and the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC).

Entitlement programs are intended to aid the elderly, and age is the primary eligibility requirement for entitlements. The value of taxes paid into the program and the number of years worked by the recipient also affect eligibility and the value of benefits. For the purposes of this brief, Medicare and Social Security benefits are entitlement programs. Social Security benefits include self‐benefits and benefits on behalf of children. The Census Bureau’s 2021 Survey of Income and Program Participation (SIPP) doesn’t survey every welfare or entitlement program, but the programs that it does survey are responsible for the vast majority of American welfare state spending.4

Methodology and Data Sources

This brief uses Wave 1 and 2 microdata from the SIPP. The SIPP is a household‐based survey constructed from a series of national panels that sample householders interviewed over a multiyear period, and it provides information on the relationship between household income, participation in government programs, and demographics.5 The survey is conducted in “waves,” meaning that the first series of responses from a given panel constitutes Wave 1 for that panel, the next year’s interviews of that same panel covering the next calendar year constitute Wave 2 of that panel, and so on.

Waves 1 and 2 of the 2021 SIPP cover the usage rates and dollar values of means‐tested welfare and entitlement programs from January to December 2020. In our 2022 Cato policy brief on this topic that analyzed welfare for the year 2019, only Wave 1 data were used since this was the only sample available that covered the 2019 calendar year.6 However, the 2021 SIPP data set contains Wave 1 data for the 2021 panel and Wave 2 data for the 2020 panel, both of which cover the 2020 calendar year. Including both waves doubles the sample size and improves the accuracy of the results, with the only methodological change necessary being that the 2020 panel survey weights must be used for the Wave 2 data. Apart from this change, the same methodology and data sources are used as in previous Cato briefs on the topic.7 Population data come from the Current Population Survey (CPS).8

There are several steps necessary to calculate the value of per capita welfare consumption for immigrants and native‐born Americans. The first step involves using the appropriate survey questions in the SIPP to calculate the dollar amount spent per capita on welfare used by immigrants and native‐born Americans. To reduce bias in point estimates, we use the SIPP’s provided survey weights in this step. Second, we use the SIPP population data and the estimates from step one to calculate the total amount of dollars used by each program. Third, we calculate the weighted proportion of all welfare benefits used by immigrants and native‐born Americans by age group. Fourth, to adjust for underreporting of welfare consumption, we multiply the weighted proportion in step three by the actual budget outlays for welfare programs in 2020 according to the U.S. budget and state welfare spending on the same programs,9 which was a necessary step because the underreporting of welfare consumption is a major problem in all surveys.10

The state welfare expenditures on these programs are included here to provide a fuller picture of the welfare state. As a result of adding state welfare expenditures, the dollar amounts in the tables and figures are not directly comparable with Cato’s briefs on welfare use in 2016 when it comes to Medicaid, SSI, and TANF,11 but are directly comparable to the most recent brief examining welfare use in 2019.12 Step four assumes that native‐born Americans and immigrants in each age group underreport welfare consumption at the same rate. The fifth and final step is to divide the product from step four by the real 2020 population of native‐born Americans and immigrants, as reported by the CPS. The result is the per capita welfare cost for immigrants and native‐born Americans for each welfare and entitlement program.

There are several nuances in welfare program eligibility in the SIPP data set that must be understood to accurately interpret the results. Program eligibility and the value of benefits received are based on the unit of assistance, which is either the individual or the household. Individuals are the unit of assistance for Medicaid, SSI, Social Security benefits, and Medicare. The household is the unit of assistance for WIC, TANF, and SNAP. The SIPP data set does not allow us to divide the welfare benefits legally received by the members of a household for programs with a household unit of assistance. Therefore, we divide the benefits from WIC, TANF, and SNAP equally across all members of the household.

Other studies evaluating immigrant welfare participation and consumption use the household as the unit of analysis for all programs.13 However, we dispute this approach because many spouses and children of immigrants are native‐born Americans. Counting native‐born welfare consumption as immigrant consumption improperly inflates estimates of immigrant welfare use and deflates native‐born consumption. Moreover, this approach reduces usage rates and benefit levels for means‐tested welfare and entitlement programs that have an individual unit of assistance.14 A rule by the Trump administration’s Department of Homeland Security implicitly sides with our preferred measure of using an individual unit of assistance rather than the household approach.15

Because the SIPP does not record the dollar amount of Medicaid and Medicare benefits expended per user, we rely on the total expenditure numbers from the Centers for Medicare and Medicaid Services to calculate the per user expenditure rate. We first identify individuals who reported Medicare and/or Medicaid coverage in 2020 in the SIPP data and then identify the individuals who reported consuming health care services that account for most health care expenditures: hospital stays, prescription medication use, and physician visits.16 We assign these individuals the reported per enrollee expenditure amount for 2020.

Results

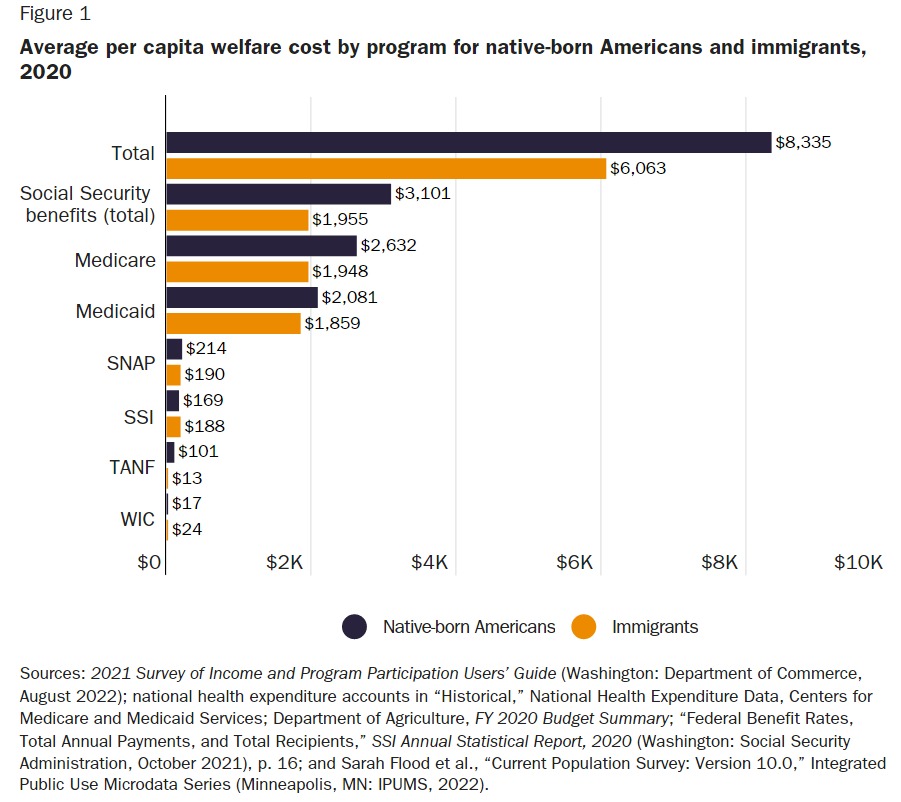

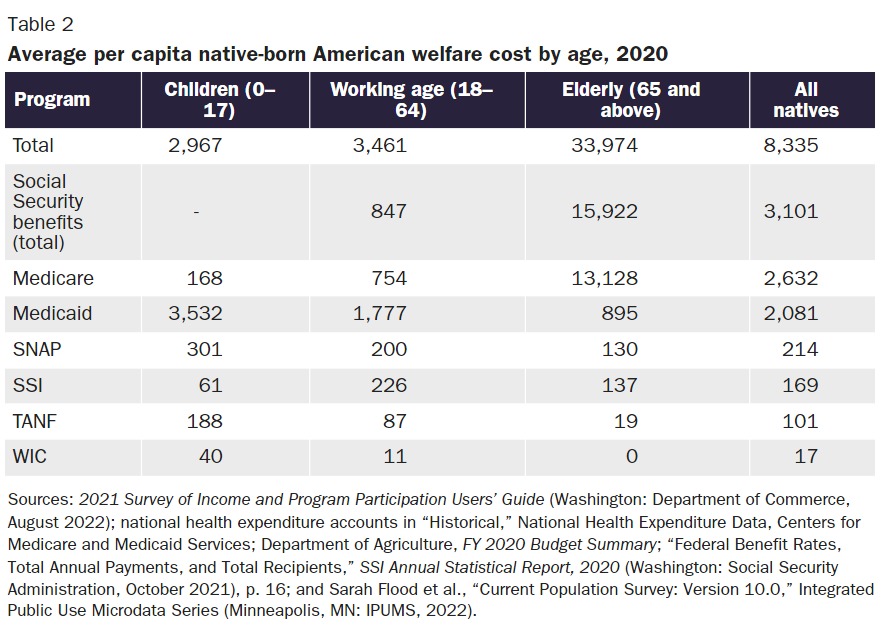

Figure 1 shows the average per capita welfare costs by program for all native‐born Americans and all immigrants. The average value of welfare benefits per immigrant was $6,063 in 2020, or 27.3 percent less than the average value of welfare benefits per native‐born American, which stood at $8,335. The average native‐born American consumed more than the average immigrant for all welfare programs covered by the SIPP other than SSI (the third‐cheapest program) and WIC (the cheapest), where immigrants consumed $19 and $7 more on average than natives, respectively. In all calculations, tables, and figures, TANF includes state maintenance of effort expenditures, which are funds that state governments are required to spend on benefits and services for needy families each year to qualify for federal TANF funding. The SSI expenditures also include federally administered state supplementation. Because SIPP data do not distinguish between the use of federal and state funds, these inclusions produce more accurate estimates.

In 2020, immigrants consumed 36.9 percent less Social Security, 26 percent less Medicare, 10.7 percent less Medicaid, 11.5 percent less SNAP benefits, and 87.6 percent less TANF benefits than native‐born Americans on a per capita basis. Immigrants also consumed less than natives per capita for those programs in 2019, with similar gaps between dollar amounts. In 2019, immigrants consumed 6.1 percent less SSI than natives on average, but they consumed 11.4 percent more than natives in 2020, which translates to $19 more than natives on a per capita basis. In 2019, immigrants consumed 11.3 percent more WIC benefits per capita than natives on average; in 2020, they consumed 42.9 percent more, which translates to $7 more than natives per capita.

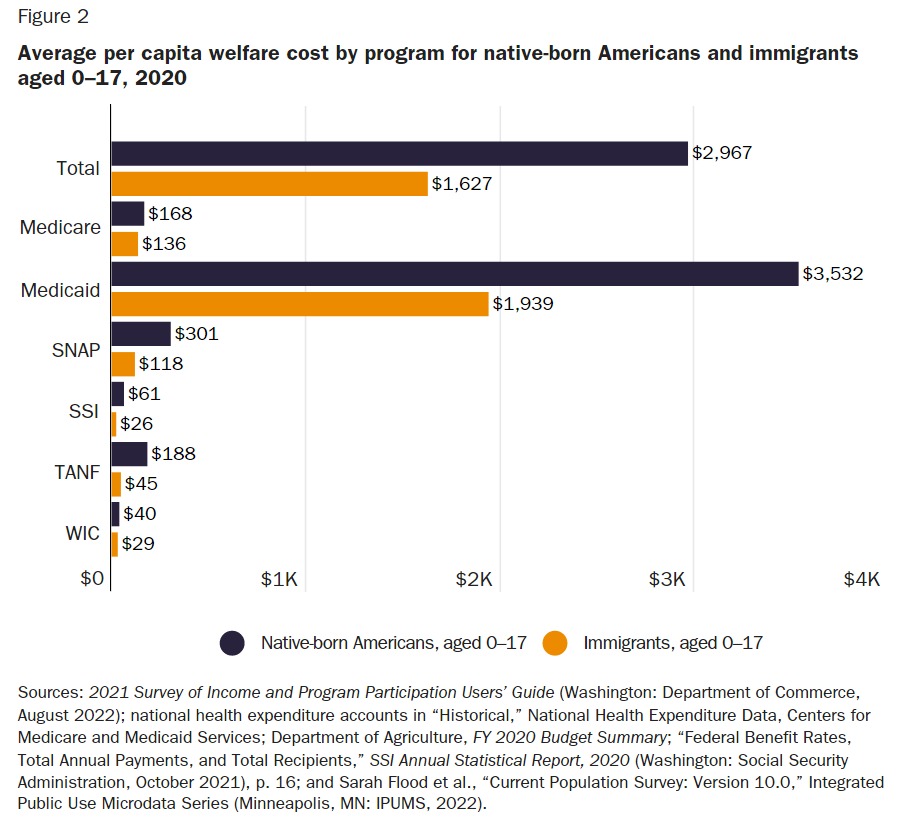

Per capita, welfare costs vary considerably by age and program. Figure 2 shows the per capita welfare cost for native‐born American and immigrant children aged 0–17. Total welfare costs for immigrant children are 45 percent lower than for native‐born American children, and the former consume less per capita than the latter for all programs. Figure 2 contains fewer welfare programs than Figure 1 because children in the 0–17 age bracket do not fulfill eligibility requirements for some programs.

Figure 3 shows the per capita welfare cost for working‐age immigrants and native‐born Americans aged 18–64. The value of welfare benefits consumed by working‐age immigrants is about 38 percent less than the value of benefits consumed by working‐age native‐born Americans. The WIC is the cheapest program and is the only one where the average value of welfare benefits consumed per immigrant is not lower than the average value of welfare benefits consumed per native: immigrants consume $16 more of WIC than natives, on average. Immigrant WIC consumption was also higher in 2019, and this persistent gap is likely because a higher proportion of immigrants are legally eligible to receive those programs. The positive gap between working‐age immigrants and native consumption in Medicaid found in our previous brief covering 2019 usage has reversed.17

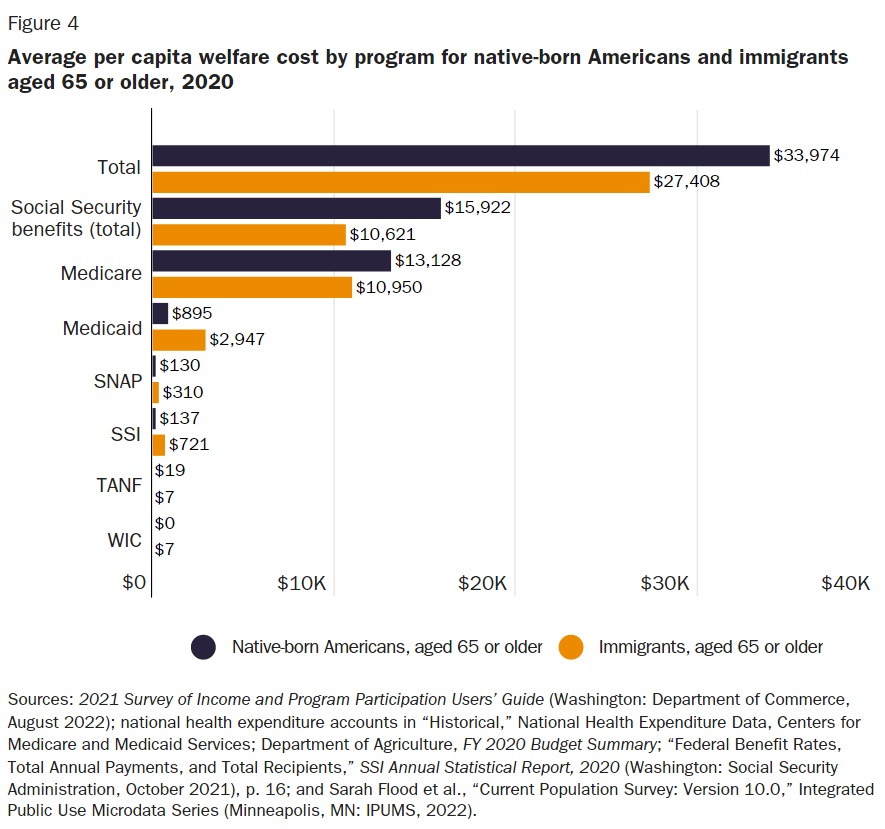

Figure 4 displays the per capita welfare cost for native‐born Americans and immigrants aged 65 or older. Elderly immigrants consume, on average, about 19 percent less in welfare benefits than elderly native‐born Americans. For Social Security benefits and Medicare, the two largest programs, elderly immigrants consume less than elderly natives; for most smaller programs and Medicaid, the opposite is true. These patterns are virtually unchanged from 2019. When compared with Figures 2 and 3, Figure 4 shows that the per capita average cost for Medicaid, SNAP, SSI, and Social Security benefits for elderly immigrants is higher than the per capita average cost for younger immigrants. Per capita, Medicare costs are also higher for the elderly but are lower for immigrants than for native‐born Americans. This difference is likely the result of elderly immigrants having less access to the more expensive entitlement programs, such as Medicare and Social Security benefits.

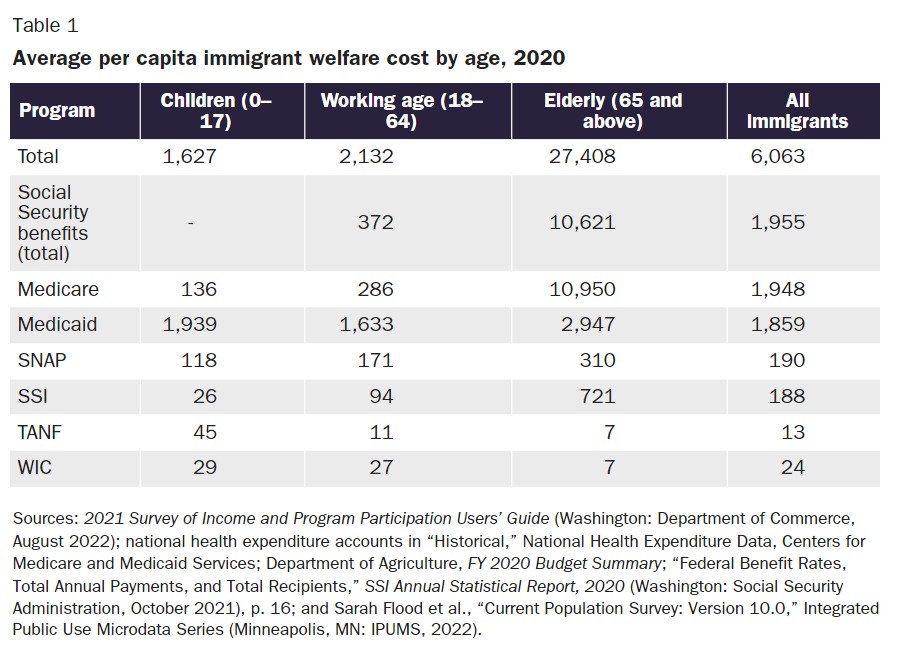

Table 1 shows the average per capita immigrant welfare cost by program and age. Immigrant age is highly correlated with per capita welfare cost. Individual elderly immigrants aged 65 or older consume about 12.8 times more welfare benefits than immigrants aged 18–64 and about 16.8 times more welfare benefits than immigrant children aged 0–17. Therefore, reducing the welfare consumption of elderly immigrants aged 65 or older will yield the largest per capita taxpayer savings. Table 2 shows the same numbers for native‐born Americans by age, where a similar but less severe pattern emerges.

Welfare Usage Rates

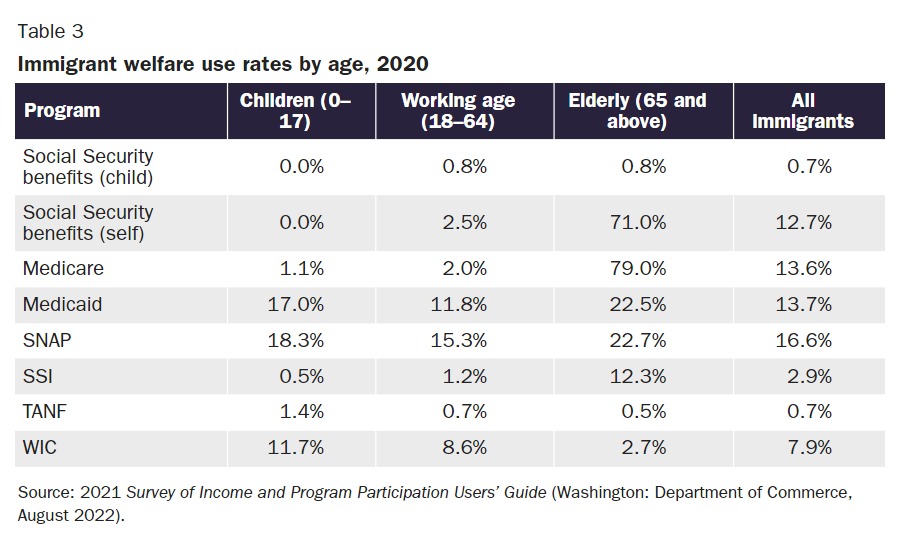

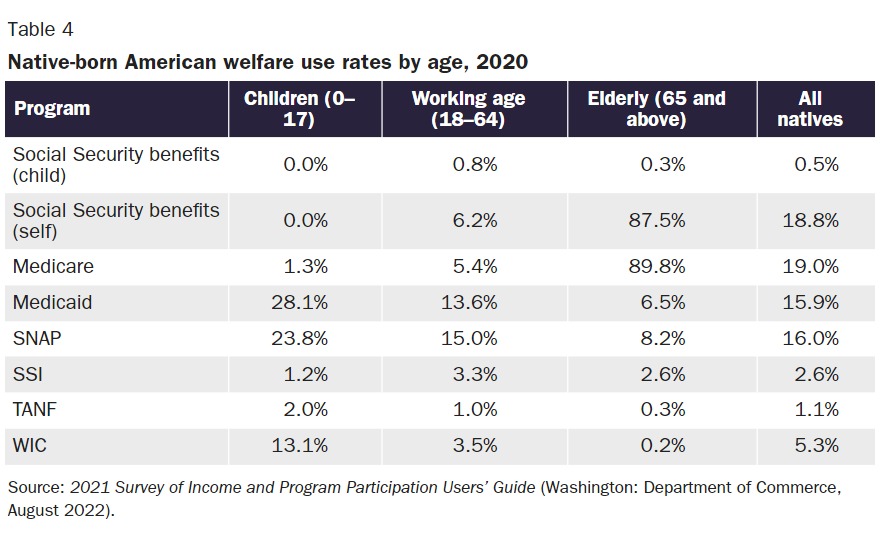

Tables 3 and 4 show the usage rates for each age group of native‐born Americans and immigrants for each welfare program. We consider a person to have used the welfare program if that person consumed the welfare benefit at any point during the 2020 calendar year. Medicare and Medicaid usage rates only include individuals who were covered by these programs and consumed their services through hospital stays, prescription drugs, or physician visits. This aligns with our previous brief covering 2019 usage but differs from our brief covering 2016 usage, in which usage rates included all covered individuals.18 This change likely improves this analysis since welfare consumption, not coverage, is the primary topic of this brief. The Social Security benefits in Tables 3 and 4 are divided between those received on behalf of children and those received on behalf of oneself.

Discussion

Overall, immigrants consumed about 27 percent less welfare and entitlement benefits in 2020 than native‐born Americans—roughly the same as in 2019. Immigrants were 14.6 percent of the U.S. population and consumed just 11.1 percent of all means‐tested welfare and entitlement benefits in 2020. Native‐born Americans consumed $2.3 trillion in means‐tested welfare and entitlement benefits in 2020, compared to $290.4 billion consumed by immigrants. If native‐born Americans consumed the same per capita dollar amount of means‐tested welfare and entitlement programs as immigrants, the total expenditures on these programs would be about $635.5 billion less.

Elderly immigrants consume more Medicaid benefits than elderly native‐born Americans, but for all other large programs and most smaller ones, natives are more expensive than immigrants in the same age groups on a per capita basis. In contrast to 2019, working‐age immigrants no longer consume more Medicaid than working‐age natives; consumption levels for this program in 2020 were roughly equal within this age group, with immigrants consuming slightly less per capita than natives.

Regarding the exception concerning elderly people using Medicaid, the same explanation we gave in our previous brief applies: fewer immigrants qualify for the more expensive Medicare; more have legal access to Medicaid and thus many of them increase their consumption of Medicaid to compensate. For instance, states have the option of providing Medicaid to pregnant lawful permanent residents, immigrant children, and illegal immigrants in emergency situations and other rare cases.19 Refugees and asylum‐seekers also have access to means‐tested welfare benefits for their first seven years in the United States.20 Minor legal changes can significantly reduce immigrants’ access to all these programs.21

Our findings here are similar to earlier briefs on this subject, including those that use the CPS data instead of the SIPP data to measure welfare use and those that use nearly identical methodologies with older SIPP data.22 Evaluating individual welfare usage—the correct methodology, according to most other researchers and implicitly endorsed by the Department of Homeland Security—is superior to the flawed household approach and yields directionally similar results regardless of whether the CPS or SIPP is used.23 In other words, other evaluations of immigrant welfare usage based on the household methodology found that immigrants use more welfare because these studies counted the welfare usage of nonimmigrants in the household.

Conclusion

Native‐born Americans consume, on an average per capita basis, more welfare and entitlement benefits than immigrants, and this pattern has held for several years. The dollar differences are most pronounced for the two largest entitlement programs, Medicare and Social Security. The largest percentage difference in per capita welfare consumption is between immigrant children and native‐born American children. Although elderly immigrants consume more Medicaid per capita than elderly native‐born Americans, and although immigrants occasionally consume more of the smaller welfare programs in certain age groups, those are the exceptions.