Taxable Ignorance

One of the few things that really irritates me is how ignorant most of us are on tax policies. Granted, the IRS Tax Code is well over 44,000 pages but you’d think that people who are going to complain about a presidential candidate’s comments on taxation would at least know the difference between an income tax and a payroll tax, right?

One of the few things that really irritates me is how ignorant most of us are on tax policies. Granted, the IRS Tax Code is well over 44,000 pages but you’d think that people who are going to complain about a presidential candidate’s comments on taxation would at least know the difference between an income tax and a payroll tax, right?

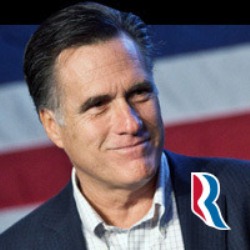

I might be asking for too much, especially given the revelation that Governor Mitt Romney said to a group of donors, “47 percent . . . are dependent upon government . . . and they will vote for this president no matter what.” The 47% comment references the fact that 47 percent of Americans do not pay any income tax, which of course set off liberals claiming that Romney is out of touch since we all pay some sort of tax at some point. This is true, but I believe his point was greater than that. I believe the point he was making is that only 53% of Americans are directly taxed on their productivity, which is why conservatives believe lowering these taxes will create jobs because it will encourage more productivity.

While 53% of Americans pay income tax, another 28% are subject to payroll taxes, and another 10% who are primarily elderly and 7% who make under $20,000 pay no taxes. What people fail to understand is that those 28% who only pay payroll taxes are operating under a flat tax system! After you make $106,800 you are not penalized by payroll taxes and will continue to only pay 15.3%, even if you make $1,000,000. However, income taxes progressively increase as your productivity increases! This is the real problem with what Governor Romney said, we have an income tax system that unfairly punishes success and fails to inspire innovation.

From a political standpoint, Governor Romney also had a point because there are large segments of the population who, for whatever reason, will not even consider voting for another candidate. This is why no one campaigns in places like Texas or New York - except to fundraise - both candidates already know who is likely to be in their camp and who isn’t; therefore, they are both equally guilty of ignoring “47 percent” of Americans in some way. The big difference between when Governor Romney “ignores” a segment of America and when President Obama does it, is that Romney finds faults in our system that prohibit productivity and Obama just makes fun of people’s beliefs in “silly” things like religion or guns.

Of course Governor Romney could have used a better choice of words when speaking to donors about who does and doesn’t pay taxes, but it doesn’t change the fact that our tax code is far too lengthy and complicated; and in turn, hinders economic activity. Are those 47% “freeloaders” or “leeches?” Not necessarily; in fact, Governor Romney is right that it is President Obama who has made them “believe that they are victims” by constantly portraying taxes as an “us versus them” scenario rather than what it is - a broken system. This debate, in a way, is about the “makers” vs. the “takers,” but only because we have a president who fails to recognize the exceptional spirit and potential of all Americans.

Comments

Facebook comments

Make sure to check out the comments on Facebook.