How to Fix Illegal Immigration: ID and Tax

In a recent series of TexasGOPVote articles, the author proposes that fixing the broken immigration system will require bipartisan legislation involving three main policies: improving border security, adjusting legal immigration to allow for the entry of needed workers, and creating a method to ID and Tax unauthorized immigrants currently in the US. This fourth article takes a closer look at ID and Tax solutions that would increase national security, level the playing field for law abiding businesses and workers, and combat inflation by increasing fiscal revenues without raising taxes on lawful taxpayers.

With an estimated 11+ million unauthorized immigrants living in the US today, it’s safe to say our nation’s immigration system is broken. To prevent future illegal immigration lawmakers must improve border security and adjust legal immigration pathways to allow for the entry of needed workers, particularly more “low-skill” workers, the lack of which has created the jobs magnet pull factor for illegal immigration.

With an estimated 11+ million unauthorized immigrants living in the US today, it’s safe to say our nation’s immigration system is broken. To prevent future illegal immigration lawmakers must improve border security and adjust legal immigration pathways to allow for the entry of needed workers, particularly more “low-skill” workers, the lack of which has created the jobs magnet pull factor for illegal immigration.

But what should be done about the unauthorized immigrants who have already been living here and working in the underground economy for many years? The most sensible solution is to create a method for them to earn legal status so the federal government can ID and tax them properly. These policies could also help remove the jobs magnet and “fix” illegal immigration if coupled with increased enforcement against employer payroll fraud.

Why ID and Tax makes sense

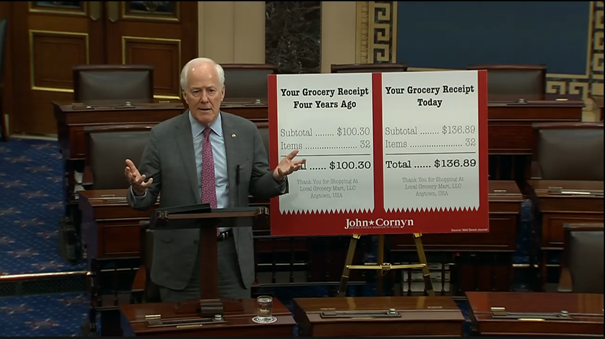

Our economy desperately needs workers given the current US economic situation with rampant inflation caused by workforce shortages. We have the largest number of open jobs in US history at 11.2 million. Deporting unauthorized immigrant workers would drastically increase the cost of food and services at a time when inflation is Americans’ top concern.

Inflation has also resulted from the printing of more US dollars to cover federal overspending. While one necessary solution to overspending is to cut spending, another is to generate more fiscal revenues. Lawmakers could ensure that more employers and workers are paying their fair share of taxes by creating a currently non-existent method for unauthorized immigrants to earn work permits and cracking down on payroll fraud. This would generate billions in fiscal revenues without raising taxes on lawful employers and workers.

Additionally, from a national security standpoint, allowing unauthorized immigrants who wish to get right with the law to do so would allow ICE and CBP to focus more resources on persecuting and deporting any unauthorized immigrants with criminal records, stopping drug smuggling, and securing the border.

Finally, the founding judicial principles of America call for justice and second chances for those who admit their crimes and do their time. Why shouldn’t there be a conditional method for unauthorized immigrants to come forward, pay their debts, and earn good legal standing?

ID and Tax Policies

Here are some suggestions of ID and Tax policies for lawmakers to work on passing.

An ID and Tax policy should allow unauthorized immigrants to register with the federal government and obtain legal status and work permits, so long as they can pass background checks and remain in good legal standing. To prevent creating a pull factor for more illegal immigration, only those who can prove they have lived in the US for at least five years prior to the passage of this legislation should qualify.

While some unauthorized immigrants will have already been paying income taxes with an Individual Tax Identification Number, those who haven’t could be required to pay any back taxes owed before being allowed to adjust to permanent legal status. While earning their status, those immigrants who are not primary caregivers should be required to maintain employment with employers that pay all required employment taxes. Requiring those earning legal status to pay taxes for 10-15 years before earning access to federal entitlement programs would greatly increase this policy’s fiscal surplus.

One simple way for Congress to do this would be through updating the “registry provision.” Current immigration law allows unauthorized immigrants who have lived continuously in the US since 1972 to register for lawful permanent resident status. Since its creation in 1929, lawmakers have updated the registry date four times, most recently in 1986. Updating the registry would not require much legislation, and perhaps could find bipartisan consensus most easily.

Another option out there is Republican Representative Maria Elvira Salazar’s Dignity Act. This bill includes a conditional 15-year method for unauthorized immigrants to earn permanent legal status while working legally. It also includes comprehensive border security and enforcement provisions.

Payroll Fraud and Misclassification

In addition to creating a program to ID and Tax unauthorized immigrants, lawmakers will need to implement policies to increase enforcement against payroll fraud in order to ensure that all workers and employers are paying their fair share in taxes.

Payroll fraud involves illegal practices committed intentionally by employers to avoid tax and insurance obligations.

Payroll fraud occurs through worker misclassification when an employer intentionally files their worker as an independent contractor when they should be filed as an employee. If employers classify a worker as an employee, they’re responsible for Medicare and Social Security taxes, Texas unemployment taxes, Worker’s Compensation insurance, and overtime wages. By labeling a worker as an independent contractor, employers are able to avoid these obligations and undercut and underbid employers who follow the rules.

Another common form of payroll fraud is the underground economy, or cash wages off the books, where employers can easily avoid tax obligations and insurance and criminal liabilities. Many unauthorized immigrants are forced to work in the underground economy because they lack employment authorization. Allowing them to earn work permits would also allow them to work for tax paying employers.

Payroll fraud has consequences not only for law-abiding workers and businesses, but taxpayers as well. Workers involved lack employee benefits and are more easily taken advantage of. Workers and businesses who follow the rules and pay their taxes get undercut by those who don’t. Taxpayers are cheated because the federal and state governments are missing out on billions in annual tax revenues.

To combat payroll fraud, lawmakers and the administration need to adopt more definite laws around when workers should be filed as an employee vs. independent contractors. They also need to increase enforcement against employers that knowingly commit payroll fraud, perhaps also adopting more strict penalties.

Furthermore, after creating a method for unauthorized immigrants to earn legal status and increasing pathways of legal immigration for needed workers, the federal government should adopt an improved version of E-verify that works efficiently and effectively, and mandate its use by employers nationwide. These three policies combined could effectively eliminate the jobs magnet, which is arguably the largest pull factor for illegal immigration.

Not only would these policies increase fiscal revenues without raising taxes, they would also help to level the playing field for law-abiding workers and businesses who are being undercut and underbid by cheating employers, which would increase overall wages in those industries over time.

Conclusion

An ID and Tax solution would go a long way in benefiting the American economy and workforce, combatting inflation, and preventing future illegal immigration. With inflation hitting historic highs and making Americans poorer by the day, right now lawmakers should be taking an all of the above strategy to combat it that includes sensible immigration solutions like those outlined in this How to Fix the Broken Immigration System series.

Part I: How to Fix the Broken Immigration System

Part II: How to Fix the Border

Part III: How to Fix the Legal Immigration System