Tax Reform

January 20th, 2021

Today, I attended the inauguration ceremonies for the 46th President of the United States, Joseph R. Biden, and Vice President Kamala D. Harris.

December 18th, 2020

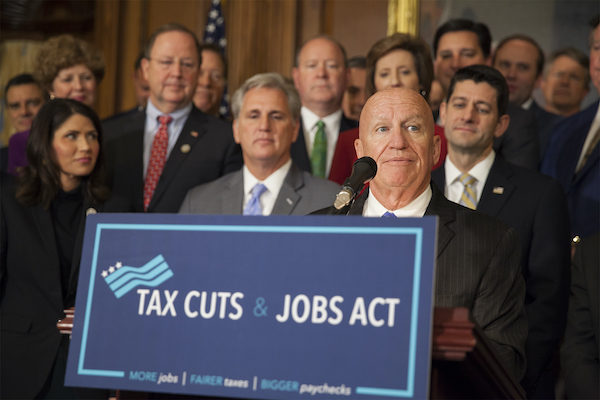

This month marks the three-year anniversary of the Tax Cuts and Jobs Act (TCJA) that aided America’s middle class, strengthened the economy, and made America more competitive globally. After years of the slow Obama-Biden...

March 10th, 2020

While the Trump tax reform provided a nice boost to the economy there is still unfinished business. Specifically, all our taxes are NOT indexed for inflation, which is bad. This needs to change.

July 30th, 2019

Indexing capital gains to inflation would unlock capital for investment, increase wages, create new jobs, and grow the economy, benefiting Americans across all income levels. Any decrease in the effective tax rate on capital...

July 5th, 2019

With nearly two and a half million miles spent commuting from my home in Texas to Congress, most airline flights are pretty routine for me.

April 12th, 2019

I believe that making the historic tax cuts permanent is a step forward for Congress to deliver on our promises made to the American people.

February 5th, 2019

Most of the American people probably aren't aware or need to be reminded of what has actually happened the last two years. And I hope the president will reflect on that.

December 24th, 2018

115th Congress By The Numbers

November 16th, 2018

I released the following statement after Republican House members voted to elect Kevin McCarthy (R-CA) as Minority Leader and Steve Scalise (R-LA) as Minority Whip for the 116th Congress:

November 2nd, 2018

During the Obama Presidency, economic experts told us that the stagnation we experienced in the American economy was the “new normal,” and we just needed to get used to it. I always rejected that notion because I believe in...

December 23rd, 2020

Three years ago, House Republicans and President Trump rewrote our nation’s tax code for the first time in 30 years.

October 9th, 2020

As former Vice President Joe Biden and Democrats in Congress advocate for tax hikes on the wealthy and intrusive regulation on small businesses and workers, Americans know you can’t “Build Back Better” by dragging down the...

August 26th, 2019

It takes a lot of courage to make two grossly false claims in a respected publication in less than 40 words. But as the national debt continues to grow—and as Republicans continue to offer bicameral solutions for tackling...

July 22nd, 2019

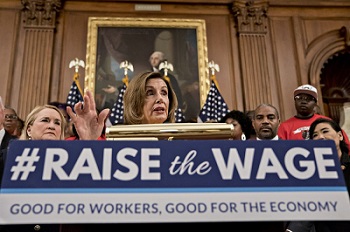

Recently I released the following statement after voting against H.R. 582, the Raise the Wage Act, which passed the House of Representatives 231-199:

April 23rd, 2019

Tax Day has come and gone, and the truth is that the vast majority of American taxpayers have benefited from the Tax Cuts and Jobs Act.

April 9th, 2019

The Ways and Means Committee has been working hard on three important, bipartisan bills to reform the IRS, develop our workforce, and make retirement programs work for all Americans.

February 4th, 2019

The latest jobs report once again exceeds expectations. For 16 consecutive months, America has created at least 100,000 jobs, including over 300,000 jobs in January. More people are entering the workforce and wages are on...

December 11th, 2018

I released the following statement after

November 13th, 2018

“Jobs smash estimates with gain of 250,000, wage gains pass 3% for first time since recession” - What an amazing headline from CNBC last week and there is no doubt about it—the American economy is booming. Across the nation...

November 2nd, 2018

Recently in Washington, disruption has been the name of the game. We’ve witnessed protesters climbing statues, disobeying police, screaming at Senators in elevators, and chasing them and their wives from restaurants. Amidst...