Taxes

October 16th, 2018

With the lack of coverage by the media, you may have missed the House of Representatives pass three important bills that will help ensure continued momentum from the Tax Cuts and Jobs Act.

October 10th, 2018

House Republicans decided to bet on the American people when we passed the Tax Cuts and Jobs Act - letting families keep more of their hard-earned paychecks and helping small business owners invest in their...

July 13th, 2018

The U.S. Department of Agriculture released a study estimating the positive effects the Tax Cuts and Jobs Act will have on farmers and ranchers.

June 11th, 2018

I released the following statement on President Trump’s recissions package submitted to Congress:

April 18th, 2018

U.S. Senators Dean Heller (R-NV), Pat Roberts (R-KS), and I yesterday introduced the Small Business Taxpayer Bill of Rights Act, legislation to slash red tape for taxpayers and allow small business owners to spend...

April 16th, 2018

Recently, U.S. Congressmen John Larson (CT-01) and I introduced the Medical Debt Tax Relief Act (H.R. 5493), which would ensure that the IRS cannot tax medical debt that has been forgiven.

March 7th, 2018

Last year, Congress passed landmark legislation, the Tax Cuts and Jobs Act. This legislation cuts taxes in every income group.Now, Texans are seeing the impact of this pro-family, pro-growth tax reform. And so are the...

March 5th, 2018

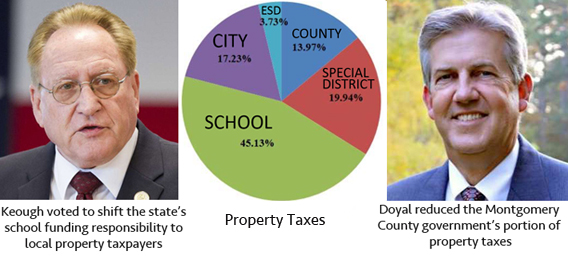

One of the main concerns for residents of Montgomery County is the increasing property tax burden. The county and state government finance systems are so complex that it is easy for misconceptions to arise about how the...

February 27th, 2018

Hurricane Harvey unleashed torrential rainfall – greater than 60 inches in some places – killing 88 people and displacing 30,000. Slamming ashore about six months ago, Harvey caused an estimated $198 billion in damages,...

February 19th, 2018

There is much heated debate right now over skyrocketing property taxes in Texas and who is to blame. Who's the real culprit? Who's been fighting to cut your property taxes in Montgomery County?

October 11th, 2018

It should be clear to everyone, because of the efforts of President Trump and our Republican lawmakers, Americans are now paying less in taxes. As promised, President Trump is bringing jobs back to America. He is removing...

August 28th, 2018

The tax reform we enacted last year is producing results. Instead of having the highest corporate tax rate in the developed world, the United States is a more attractive place to work and save and invest.

June 26th, 2018

I recently addressed Texas members of the National Federation of Independent Business (NFIB). There I discussed my priorities for 2018, including my efforts to cut taxes, repeal Obamacare, and reduce the burden of federal...

May 31st, 2018

Thanks to tax reform, Texas utility company, Quadvest, is lowering rates for Texans. In the few months following the passage of the Tax Cuts and Jobs Act, utility companies in 48 out of 50 states have taken action...

April 17th, 2018

We’re celebrating Tax Day this year because April 17 marks the last time that taxpayers will ever have to deal with the old, broken tax code.

March 28th, 2018

Yesterday, I visited local olive oil bar, The Oilerie in The Woodlands. I met with store owners, Greg and Jo Anna Zachary, to hear first-hand how tax reform positively impacted their business.

March 5th, 2018

I authored the following Op-Ed in the Waco Tribune highlighting the historic reforms included in the Tax Cuts and Jobs Act that are already making a di

March 2nd, 2018

I'd like to mention briefly two iconic companies that are showing their devotion to Texas in a much different but important manner. Based in Tyler, they are spreading the good news of the Tax Cuts and Jobs Act, the law that...

February 23rd, 2018

I issued the following statement after Ways and Means Committee Republicans concluded their annual retreat to lay out their policy agenda for 2018:

January 31st, 2018

I released the following statement in response to President Trump’s State of the Union address: