Taxes

December 15th, 2017

Recently I delivered the following opening statement at the conference committee hearing on H.R. 1, the Tax Cuts and Jobs Act. The legislation will deliver a tax cut to middle-class families, raise wages, grow the economy,...

December 13th, 2017

Recently at a press conference, I discussed the importance of passing tax reform to round out a successful year for the Senate. Excerpts of my remarks are below, and video of my remarks can be found here.

December 5th, 2017

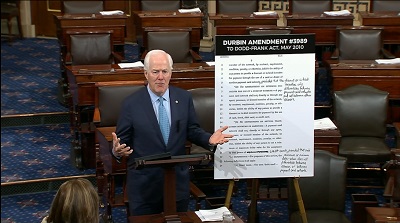

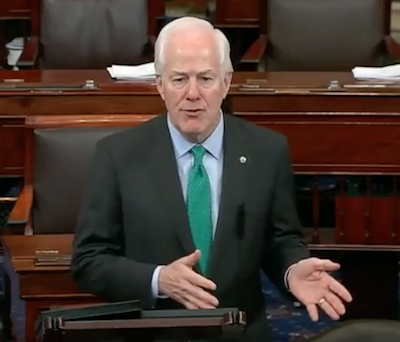

On the Senate floor, I praised Republicans for pushing past Democrats’ hypocritical attempts to stall efforts to pass the Tax Cuts and Jobs Act. Excerpts of my remarks are below, and video of my remarks can be found...

December 4th, 2017

Yesterday, I filed an amendment to the Senate’s tax reform bill that seeks to expand 529 College Savings Plans to include K-12 elementary and secondary school tuition for public, private, and religious schools, including K-...

November 28th, 2017

Today at a press conference, I discussed what tax reform legislation means for the American economy and the importance of passing the Senate’s Tax Cuts and Jobs Act. Excerpts of my remarks are below, and video of my remarks...

November 20th, 2017

I released the following statement applauding the passage of the pro-growth tax reform package:

November 16th, 2017

Today I voted in support of The Tax Cuts and Jobs Act, which raises take-home pay and creates jobs. The bill passed 227-205.

November 10th, 2017

Recently on the Senate floor, I urged my Democrat colleagues in the Senate to join the Republican effort to overhaul our outdated tax code and continue their support for tax reform principals they have endorsed in the past...

November 6th, 2017

I released the following statement in response to the Labor Department’s October 2017 jobs report:

November 1st, 2017

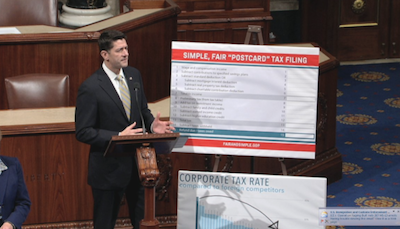

It’s no secret that our tax system is outdated, overly complicated, and full of loopholes, and anyone in Washington can tell you that tax reform – especially bipartisan tax reform – isn’t easy.

December 14th, 2017

Yesterday I delivered the following opening statement at a meeting of the House-Senate Conference Committee on H.R. 1, the Tax Cuts and Jobs Act.

December 12th, 2017

On the Senate floor, I discussed the importance of tax reform to helping middle class families keep more of their hard earned money.

December 4th, 2017

The U.S. Senate took a major step forward for tax reform and the American people early Saturday morning. For the first time in 31 years, the House and the Senate have each passed legislation that will deliver real tax relief...

December 2nd, 2017

The Senate passed the Tax Cuts and Jobs Act today.

November 21st, 2017

In a low turnout election, a small percentage of voters voted for all of the $1.495 billion City of Houston bond issues.TCR has been quite clear about the fiscal irresponsibility of these bonds and the negative impact it...

November 20th, 2017

The U.S. House of Representatives – the People’s House – took action last week on the most transformational tax overhaul in a generation. This legislation brings us one step closer to delivering bold, pro-growth, pro-family...

November 15th, 2017

Last Thursday, the Senate Finance Committee introduced our proposal that would enable more Americans to keep more of their hard-earned paychecks and send less of their money to Uncle Sam here in Washington, D.C.

November 8th, 2017

The Republican tax proposal is now public and while the overall plan will prove beneficial to the economy many challenges remain. The individual tax rates will lower middle class taxes by doubling standard deductions and...

November 2nd, 2017

America’s complicated and broken tax code is hurting our economy and, in turn, American families. That’s why I’ve long said we need a simpler tax code that rewards hard work.

October 30th, 2017

U.S. Senators Bill Cassidy (R-LA) and I, members of the Senate Finance Committee, authored the following op-ed in Forbes addressing how revamping our tax system would impact the energy sector: