Taxes

October 25th, 2017

You've heard "trust but verify" from none other than Ronald Reagan, no doubt. The Tea Party movement taught us to do that, and I hope you still are. Especially in the case of John Culberson, my congressman.

October 19th, 2017

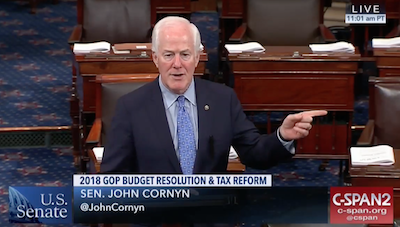

On the Senate floor, I discussed a recent bipartisan meeting at the White House on tax reform. Excerpts of my remarks are below, and video of my remarks can be found here.

October 11th, 2017

Yesterday I participated in a roundtable discussion on storm recovery efforts with local community leaders in Beaumont. There, I shared my priorities for recovery, and how storm-impacted Texans can receive significant tax...

October 4th, 2017

Last week, after a caller to a radio program I was on suggested it, I reintroduced the Properly Reducing Overexemptions For Sports Act or PRO Sports Act. This legislation would exclude major professional sports leagues from...

August 4th, 2017

The Department of Labor reported today the economy added 209,000 jobs in July and the unemployment rate was 4.3 percent.

July 26th, 2017

The focus on which bathrooms people can use is distracting people from a "disingenuous" effort to lower property taxes and and a school choice bill that would "cripple funding" for rural public school districts, he said....

June 2nd, 2017

On Thursday, I joined local Texas radio hosts to discuss tax reform, and my efforts to repeal and replace Obamacare and lower health care premiums. I also praised the reports that President Trump was expected to withdraw the...

May 5th, 2017

Democratic activists have a "brilliant" idea (not) to give us a state income tax. To be clear, none of the current major taxes go away and why should they? Paternal government knows better than you, so we need to give them...

April 29th, 2017

Historic, bold tax reform is what Texans have waited years for and Wednesday they have a White House, the House and the Senate all moving in the same direction.

April 26th, 2017

A lot of you may be asking yourself "Why would anyone be against a Balanced Budget?"

October 23rd, 2017

Recently on the Senate floor, I discussed the importance of passing the FY2018 Budget Resolution, which is necessary to enacting tax reform. Excerpts of my remarks are below, and video of my remarks can be found here.

October 19th, 2017

Last night I debated Sen. Bernie Sanders (I-Vt.) in a CNN Town Hall regarding tax reform. During the debate, I called for eliminating the estate tax, also known as death tax, as a part of tax reform.

October 5th, 2017

FAIR’s report reaches that conclusion by vastly overstating the costs of illegal immigration, undercounting the tax revenue they generate, inflating the number of illegal immigrants, counting millions of U.S. citizens as...

September 13th, 2017

Responding to President Trump’s cancellation of the Deferred Action for Childhood Arrivals (DACA) program, Congress is moving toward a compromise that could legalize the DREAMers in combination with more immigration...

July 28th, 2017

Washington, D.C., July 17, 2017 – Fixing our broken tax code is critical to helping small businesses and unleashing the entrepreneurial potential of our nation, wrote the Small Business & Entrepreneurship Council (SBE...

July 26th, 2017

Please don't be distracted by the current "bathroom" debate in Austin. The more serious battle brewing in the Texas legislature's special session is between rural and urban Texas.

May 8th, 2017

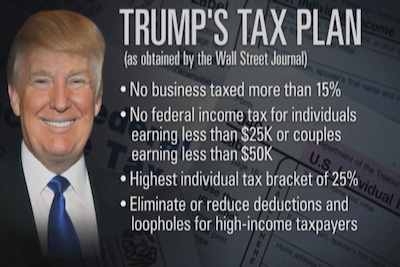

Looking at the Trump Tax Plan, what grabs you is how the corporate rate is similar to Ted Cruz’s business tax rates, which were proposed in the primary, and how similar Trump’s individual tax plan is to Marco Rubio’s while...

May 3rd, 2017

Last week, President Donald Trump came out with a plan for tax reform that lowers the corporate tax rate and simplifies taxes for individuals. Now, the House Ways and Means Committee has to get down to the hard work of...

April 26th, 2017

The White House made its opening bid for what officials called the “biggest tax cut” in U.S. history -- with cuts that would benefit businesses, the middle class and certain high-earning individuals -- but left unanswered...

April 26th, 2017

Today on the Senate floor I underscored the need for pro-growth tax reform in advance of the release of today’s blueprint from the Administration. Excerpts of my remarks are below, and video of my remarks can be found here...