Taxes

March 12th, 2024

Congressman August Pfluger released a statement following the release of President Biden's $7.3 Trillion FY2025 budget proposal:

January 26th, 2024

There are two million farms across America, 98 percent of which are operated by families. Farmers and small business owners are critical to our economy, yet Democrats want to add financial pressure by taxing their dead.

January 18th, 2024

Ways and Means Chairman Jason Smith (R-MO) and Senate Finance Chairman Ron Wyden (D-OR) announced the final Tax Relief for American Families and Workers Act. This legislation, the result of extensive bipartisan, bicameral...

February 20th, 2023

Six years ago, under the Trump administration, Republicans passed the Tax Cuts and Jobs Act (TCJA), legislation that radically transformed the economy, bringing wages that far outpaced inflation, record lows in unemployment...

August 30th, 2022

Our Founding Fathers had the wisdom to establish three branches of government to prevent any one person or institution from wielding absolute power. Perennial favorite “Schoolhouse Rock!” put it perfectly: “Everybody’s act...

August 8th, 2022

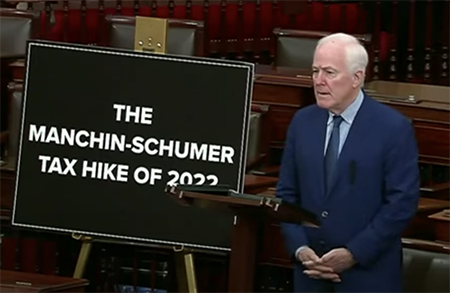

I made the following statement after voting against the Democrats’ so-called “Inflation Reduction Act,” a massive and radical spending bill crafted by Senators Chuck Schumer (D-N.Y.) and Joe Manchin (D-W.Va.):

May 20th, 2022

I recently introduced the Rural Internal Revenue Service (IRS) Accountability Act to make tax filing easier for Americans who live in rural areas and to provide much needed oversight of the IRS.

May 2nd, 2022

In the growing cities of Texas, Austin, Dallas-Fort Worth, San Antonio and metro Houston, appraisals have exploded with an average increase of 30%.

March 30th, 2022

After inflicting the worst inflation on American families in 40 years, President Biden’s new budget blunder has tax hikes that hit the middle class and small family businesses, send jobs fleeing overseas, and more socialist...

February 17th, 2022

The threat of President Biden’s tax hikes is causing damage to the economy as Main Street businesses brace for higher costs.

February 6th, 2024

The House of Representatives passed H.R. 7024, the Tax Relief for American Families and Workers Act, with a large bipartisan vote on Tuesday, Jan. 31st.

January 22nd, 2024

Rep. August Pfluger (R-TX) proudly joined Rep. Randy Feenstra (IA-04) in introducing the Death Tax Repeal Act that would permanently repeal the death tax, which imposes an unfair and costly tax on the transfer of property,...

November 21st, 2023

Congresswoman Beth Van Duyne, a member of the House Committee on Ways and Means, introduced legislation to repeal the harmful Superfund tax imposed through the Infrastructure Investment and Jobs Act.

February 15th, 2023

Congressman Michael McCaul (R-Texas) announced he has joined Congressman Vern Buchanan (R-Fla.) and 71 colleagues in reintroducing the TCJA Permanency Act (H.R.976), legislation to make permanent the tax cuts for individuals...

August 12th, 2022

I released the following statement after news that inflation remains at historical highs, with the Consumer Price Index (CPI) at 8.5 percent. This report comes just days before House Democrats are set to pass a massive,...

August 8th, 2022

I made the following remarks on voting against Senate Democrats’ reckless tax-and-spending bill. Video can be found here.

May 4th, 2022

Congressman Jake Ellzey Join Colleagues in Sending Letter Opposing President Biden’s Farm Killer Tax

Last week, I joined 28 of my colleagues in sending a letter to President Biden expressing concerns with provisions in the President's Fiscal Year 2023 budget that threaten the stepped-up tax basis and impose 'mar

April 19th, 2022

Nearly 10 months later, the Biden Administration still does not know what taxpayer data was stolen and leaked to ProPublica last summer. It’s hard to investigate a crime when you don’t know what was stolen.

March 29th, 2022

I strongly believe that the American people know best what to do with their own money, and by supporting the Protecting Family and Small Business Tax Act, we can make sure they have that chance.

February 16th, 2022

The worst thing Washington could do now is fuel inflation with more spending or impose tax hikes on employers that ultimately show up in higher prices for customers and higher taxes on their workers.